View from the Observation Deck

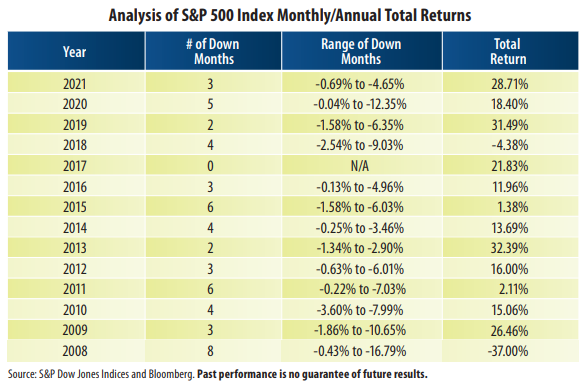

1. In 2017, the S&P 500 Index ("index") did not register a single down month on a total return basis, which includes reinvested dividends. That is not typically the case.

2. In 13 of the past 14 calendar years (2008-2021), which includes the 2008-2009 financial crisis, the index endured no less than two negative total return months and as many as eight (see table).

3. In 2021, the S&P 500 Index endured three down months (January, September and November), according to S&P Dow Jones Indices.

4. In 2020, there were five down months and the -12.35% total return posted in March marked the largest monthly decline for any year in the table following 2008. Despite the five down months, the index posted a total return of 18.40%.

5. From 2008 through 2021, the S&P 500 Index endured a loss in 53 of the 168 months on a total return basis, or approximately 31.5% of the time. Over that same period, the index posted an average annualized total return of 11.03%, according to Bloomberg.

6. For comparative purposes, from 1926 through 2021, the S&P 500 Index posted a loss in 25 of the 96 calendar years on a total return basis, or approximately 26.0% of the time, according to data from Ibbotson Associates/Morningstar. Over that same period, the index posted an average annual total return of 10.46%.

7. Stock prices don't rise in a straight line. Investors are going to encounter some turbulent times along the way. Remember, the S&P 500 Index has never failed to fully recoup any losses sustained from corrections or bear markets over time.

8. A Bloomberg survey of 19 equity strategists found that their average 2022 year-end price target for the S&P 500 Index was 4,950 as of December 16, 2021, according to its own release. The highest and lowest estimates were 5,330 and 4,400, respectively. The index closed trading on December 31, 2021, at 4,766.18.

9. Brian Wesbury, Chief Economist at First Trust Advisors L.P., announced on December 13, 2021, that he is looking for a 2022 year-end price target of 5,250.

This chart is for illustrative purposes only and not indicative of any actual investment. The illustration excludes the effects of taxes and brokerage commissions and other expenses incurred when investing. Investors cannot invest directly in an index. There can be no assurance that any past trends will continue or that projections cited will occur. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.