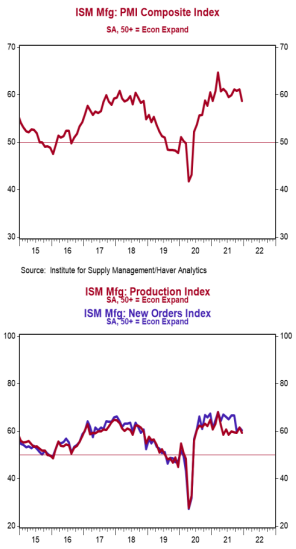

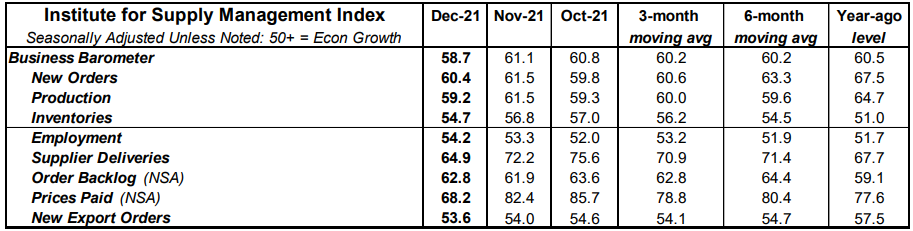

• The ISM Manufacturing Index declined to 58.7 in December, coming in below the consensus expected 60.0. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

• The major measures of activity were mostly lower in December, but all above 50, signaling growth. The production index fell to 59.2 from 61.5 in December, while the new orders index declined to 60.4 from 61.5. The employment index rose to 54.2 from 53.3, and the supplier deliveries index fell to 64.9 from 72.2 in November.

• The prices paid index fell to 68.2 in December from 82.4 in November.

Implications:

The manufacturing sector continued to expand in December, though at a slower pace, with fifteen of eighteen industries reporting growth. While both the new orders and production indices remain solidly in expansion territory, it’s clear the factory sector would be growing even more rapidly if it weren’t for a slew of unusual factors holding back output. Respondent comments in December continued to be dominated by widespread worries about input availability, labor shortages and retention, and transportation pressures. These issues have all come together to keep manufacturing activity from rising quickly enough to meet the explosion of demand as the US economy reopens. However, there has been recent progress on several fronts. For example, the supplier deliveries index looks to have peaked in May and posted its largest monthly decline in over a year in December, signaling that supply chain issues are easing. That said, delays are far from over, with fourteen of eighteen industries reporting waiting longer for inputs. This, in turn, has resulted in long lead times for the clients of US factories, who continued to see their inventories shrink in December. Keep in mind, businesses will eventually restock their shelves, which will be a big source of future demand for manufactured goods as well as a tailwind for GDP growth. There has also been recent progress on hiring, with the employment index rising for the fourth month in a row. However, staffing troubles remain a persistent issue when it comes to ramping up production. Manufacturing is one of the worst hit sectors in the ongoing labor shortage, with job openings twice what they were pre-pandemic. Notably, the recent recovery in the employment index has coincided with the end of generous federal pandemic unemployment benefits which expired in September. With less disincentive effects in the labor market, we expect the shortage of workers to continue to abate in coming months. Finally, there also seems to be progress on the inflation front. Price growth for inputs slowed in December, with the prices paid index falling to a still-high 68.2. It looks like factory-related price growth peaked back in June and has been slowing consistently since, with December posting the largest monthly decline for the index so far during the aftermath of the pandemic, though some of this was likely the result of large declines in energy costs as Omicron first emerged. This is consistent with our view that inflation remains a problem but won't be quite as rapid in 2022 as it was last year. We also recently got data on construction spending, which rose 0.4% in November. Looking at the details, large increases in home building and manufacturing projects more than offset declines in road construction and healthcare. In other recent news, home prices keep rising, but not as fast as earlier in the COVID era. The national Case-Shiller index rose 1.0% in October, a large gain by normal standards, but the slowest increase for any month since mid2020. Still, the index is up 19.1% from a year ago, led by price gains in Phoenix and Tampa, with the slowest gains in Chicago, Minneapolis, and Washington, DC. The FHFA index, which measures prices for homes financed by conforming mortgages, increased 1.1% in October and is up 17.5% from a year ago. Look for continued national price gains in 2022, but not nearly as fast as in 2020-21.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security