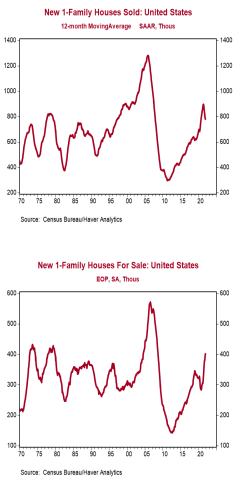

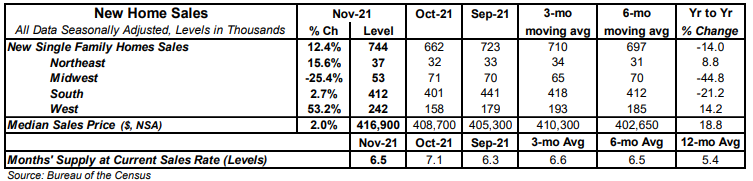

- New single-family home sales increased 12.4% in November to a 0.744 million annual rate, lagging the consensus expected 0.770 million. Sales are down 14.0% from a year ago.

- Sales in November rose in the West, Northeast, and South, but fell in the Midwest.

- The months' supply of new homes (how long it would take to sell all the homes in inventory) fell to 6.5 in November from 7.1 in October. The drop was entirely due to a faster pace of sales which more than offset a 10,000 unit increase in inventories.

- The median price of new homes sold was $416,900 in November, up 18.8% from a year ago. The average price of new homes sold was $481,700, up 21.6% versus last year.

Implications: We think new home sales are in a general upward trend, but today's data were not as good as the headline gain made it appear. New home sales posted the largest percentage gain in more than a year in November, but very large downward revisions to prior months means there wasn't much to celebrate in today's report. If October's sales pace was still at the original reading of 0.745 million, today's headline gain of 12.4% would have instead been a decline of 0.1%. This makes two months in a row where earlier data has been revised down and demonstrates that the housing market has struggled to find its footing after a series of weak reports earlier this year. Why? We think for two main intertwined reasons: a lack of supply of completed homes plus rapid price appreciation versus pre-COVID levels. The good news is that builders have been ramping up activity, with the total number of single-family homes under construction currently at the highest levels since 2007. Ultimately, that added supply will facilitate more sales while slowing the pace of new home price appreciation. In the meantime, buyers are still stuck dealing with very few options when it comes to completed homes. It's true that overall inventories have been rising recently and now sit at the highest level since 2008. This has pushed up the months' supply (how long it would take to sell the current inventory at today's sales pace) to 6.5 from a record low reading of 3.5 in late 2020. However, almost all of this inventory gain is from homes where construction has either not yet started or is still underway. Doing a similar calculation with only completed homes on the market shows a months' supply of a meager 0.6, near the lowest level on record back to 1999. The good news is that the inventory of completed homes has been rising consistently since July, signaling a return to an upward trend after nearly a year straight of declines. Given that builders have plenty of projects in the pipeline to meet demand, it looks likely that they will keep construction activity running on all cylinders for the foreseeable future. As more homes become available, we expect demand will remain strong and help boost sales in 2022.