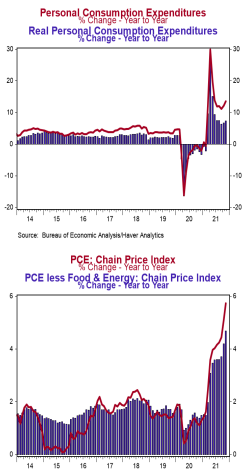

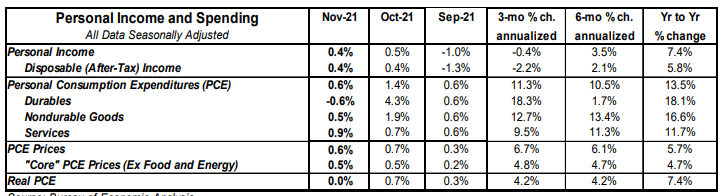

- Personal income rose 0.4% in November, matching consensus expectations. Personal consumption rose 0.6% in November ( 0.8% including prior months' revisions), also matching consensus expectations. Personal income is up 7.4% in the past year, while spending has increased 13.5%.

- Disposable personal income (income after taxes) increased 0.4% in November and is up 5.8% from a year ago.

- The overall PCE deflator (consumer prices) rose 0.6% in November and is up 5.7% versus a year ago. The "core" PCE deflator, which excludes food and energy, rose 0.5% in November and is up 4.7% in the past year.

- After adjusting for inflation, "real" consumption was unchanged in November, but is up 7.4% from a year ago.

Implications:

Personal income rose 0.4% in November, as both wages and government transfer payments contributed to more cash in consumers' pockets. Following two months of declines as extended unemployment benefits ended and individuals returned to the workforce, government transfer payments rose in November as payments from the Provider Relief Fund (PRF), which sent checks to health care providers, more than offset declining payments from other programs. Far more important (and sustainable) income gains came as private-sector wages and salaries rose 0.5% in November and are now up a whopping 9.7% in the past year. And with extra funds to spend during the holiday season, consumption rose 0.6% in November, led by spending on services. And spending growth should continue. Job growth continues, wages are going up quickly, and some people saved transfer payments they received during COVID, giving them more (temporary) spending power. On the inflation front, PCE prices grew 0.6% in November, and are up 5.7% from a year ago. Core prices, which exclude food and energy, rose 0.5% in November and are up 4.7% from a year ago, supporting the Federal Reserve's recent decision to accelerate the pace of tapering in anticipation of raising rates in 2022. In other news out this morning, durable goods orders jumped 2.5% in November and are up 14.7% in the past year. Orders excluding transportation rose a very healthy 0.8% in November and are up 13.4% from a year ago. One of the most important numbers for GDP purposes, shipments of non-defense capital goods excluding aircraft, rose 0.3% in November, and if unchanged in December, will be up at a 6.7% annualized rate in Q4 versus the Q3 average. On the employment front, initial unemployment claims were unchanged at 205,000 last week. Meanwhile, continuing claims fell 8,000 to 1.859 million, a new low for the pandemic recovery. Expect a solid payroll report for December.