View from the Observation Deck

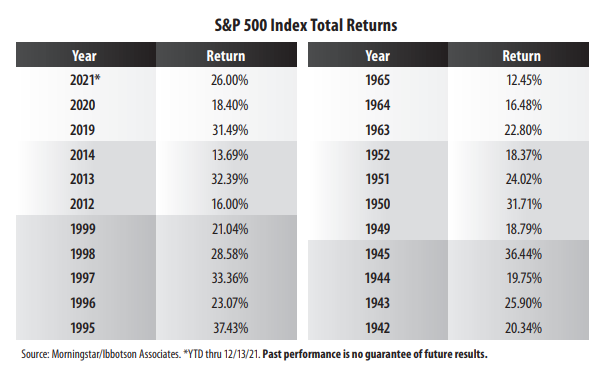

1. If the S&P 500 Index holds on to its double-digit total return in 2021, it will mark the sixth time since 1926 that it has done so for three or more consecutive years (see table).

2. For those equity investors wondering if the momentum in the market, as measured by the S&P 500 Index, can continue, the longest stretch of consecutive calendar-year double-digit total returns was five (1995-1999). This period captured the bulk of the internet revolution.

3. What do the pros think? A Bloomberg survey of 12 equity strategists on Wall Street found that their average 2022 year-end price target for the S&P 500 Index was 4,843 as of 11/19/21, according to its own release. The highest and lowest estimates were 5,300 and 4,400, respectively. On 12/13/21, the S&P 500 Index closed at 4,668.97, which was 0.91% below its all-time closing high of 4,712.02 on 12/10/21.

4. Brian Wesbury, Chief Economist at First Trust Advisors L.P., issued his 2022 forecast on 12/13/21 calling for the S&P 500 Index to finish the year at 5,250.

5. As of the close on 12/13/21, the S&P 500 Index would need to post a gain of 3.73% to reach the 4,843 average year-end target from the equity strategists surveyed. It would need to generate a gain of 13.52% to hit 5,300 (highest estimate) and 12.44% to reach Wesbury’s 5,250 projection.

6. As we have noted on many occasions, whenever the stock market is trading at or near its all-time high, corporate earnings typically need to grow to push valuations higher.

7. Bloomberg’s consensus estimated earnings growth rates for the S&P 500 Index for 2022 and 2023 were 8.11% and 9.79%, respectively, as of 12/10/21.

8. While not included in the table above, the total returns posted in the years that ended the five previous streaks were as follows: 1.38% (2015); -9.10% (2000); -10.06% (1966); -0.99% (1953); and -8.07% (1946).

This chart is for illustrative purposes only and not indicative of any actual investment. The illustration excludes the effects of taxes and brokerage commissions or other expenses incurred when investing. Investors cannot invest directly in an index. The S&P 500 is a capitalization-weighted index comprised of 500 stocks used to measure large-cap U.S. stock market performance.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.