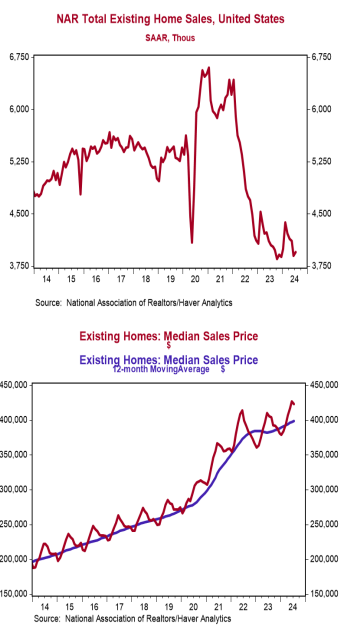

- Existing home sales increased 1.3% in July to a 3.950 million annual rate, narrowly beating the consensus expected 3.940 million. Sales are down 2.5% versus a year ago.

- Sales in July rose in the Northeast, West, and South, but remained unchanged in the Midwest. The gain in July was entirely due to single-family homes. Sales of condos/co-ops remained unchanged.

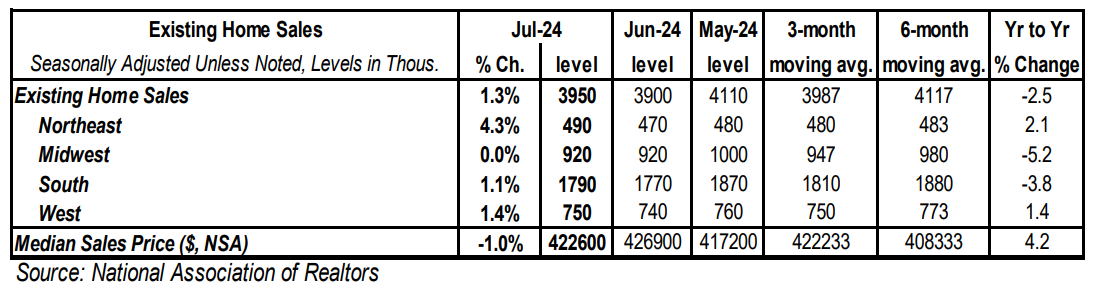

- The median price of an existing home declined to $422,600 in July (not seasonally adjusted) but is up 4.2% versus a year ago.

Implications: Existing home sales rose for the first time in five months in July, but still remain near the slowest pace since the aftermath of the 2008 Financial Crisis. It looks like the housing market remains stuck in low gear due to affordability. First, sales are still facing headwinds from mortgage rates that remain relatively high versus recent history. The good news is that 30-year fixed mortgage rates have fallen roughly 70bps over the past several months in anticipation of Federal Reserve rate cuts starting in September. However, while that decline was likely a reason for July’s modest 1.3% gain in sales, some buyers will continue delaying purchases until after the Fed actually delivers. Second, home prices are rising again with the median price of an existing home up 4.2% from a year ago. Assuming a 20% down payment, the rise in mortgage rates since the Federal Reserve began its current tightening cycle in March 2022 amounts to a 40% increase in monthly payments on a new 30-year mortgage for the median existing home. Eventually, the housing market can adapt to these increases but continued volatility in financing costs will cause some indigestion. Notably, sales of homes priced at $1 million and above have risen 26.5% in the past year versus a decline of 2.5% for all existing home sales. This demonstrates that, at least at the higher end of the market, both buyers and sellers are beginning to adjust to the new reality of higher rates. However, outside the most expensive segment many existing homeowners remain reluctant to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. This remains a major impediment to activity by limiting future existing sales (and inventories). However, there are signs of progress with inventories rising 19.8% in the past year. That has helped push the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) up to 4.0 in July, near the highest since May of 2020 although still below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. A tight inventory of existing homes means that while the pace of sales looks like 2008, we aren’t seeing that translate to a big decline in prices. In other news this morning, the Kansas City Fed Manufacturing Index, a measure of factory activity in that region, rose to a still weak -3 in August from -13 in July. Finally, in employment news this morning, initial jobless claims increased 4,000 last week to 232,000. Meanwhile, continuing claims also rose 4,000 to 1.863 million. These figures suggest some continued job growth in August, but at a moderate pace.