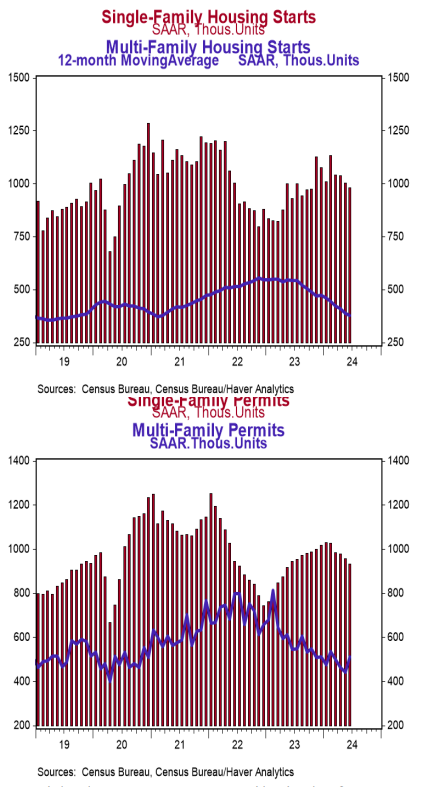

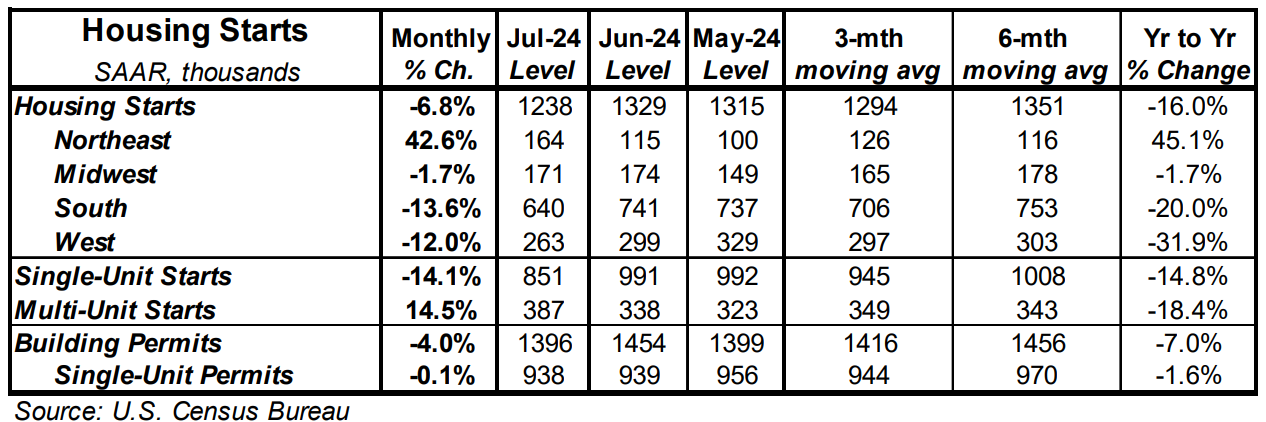

- Housing starts declined 6.8% in July to a 1.238 million annual rate, well below the consensus expected 1.333 million. Starts are down 16.0% versus a year ago.

- The decline in July was entirely due to single-family starts. Multi-family starts rose in July. In the past year, single-family starts are down 14.8% while multi-unit starts are down 18.4%.

- Starts in July fell in the South, West, and Midwest, but rose in the Northeast.

- New building permits fell 4.0% in July to a 1.396 million annual rate, lagging the consensus expected 1.425 million. Compared to a year ago, permits for single-family homes are down 1.6% while permits for multi-unit homes are down 16.4%.

Implications: July was a tough month for homebuilders, as both housing starts and new permits fell to the slowest pace since the COVID shutdowns. Moreover, the decline would have been worse but for a 14.5% jump in starts for the volatile multi-family category, which partially cushioned the drop in single-family starts to a sixteen-month low. The silver lining for future homebuyers is that builders have been focusing their efforts on completing projects already in progress. Despite a dip in July, completions are up 13.8% in the past year and stand near the highest pace seen since 2007. With strong completion activity and tepid growth in starts, the total number of homes under construction continues to fall, now down 8.3% since the start of 2024. That type of decline is usually associated with a housing bust or recession. The lack of new construction is why home prices have remained elevated while rents are still heading up in much of the country: we are building too few homes while lax enforcement of immigration laws mean rapid population growth. We think government rules and regulations are likely the major hurdle for builders in much of the country, but home construction might also be facing headwinds from a low unemployment rate (which makes it hard to find workers) as well as relatively high mortgage rates. The home building sector seems strangely slow given our population growth and the ongoing need to scrap older homes due to disasters or for knockdowns, which is why we think government rules and regulations are likely the central problem. That said, there are some tailwinds for housing construction, as well. Many owners of existing homes are hesitant to sell and give up their fixed sub-3% mortgage rates, so many prospective buyers will need new builds. In addition, Millennials are now the largest living generation in the US and have begun to enter the housing market in force, which represents a demographic tailwind for activity. Putting it together, we don’t see housing as a major driver of economic growth in the near term, but we’re not expecting a housing bust like the 2000s on the way, either. As the Fed eventually begins to cut rates, mortgage rates should trend lower as well, helping put a floor under housing later in 2024.