View from the Observation Deck

Today’s blog post is intended to provide insight into the movement of bond prices relative to changes in interest rates. For comparative purposes, the dates in the chart are from prior posts we’ve written on this topic. Click here to view our last post.

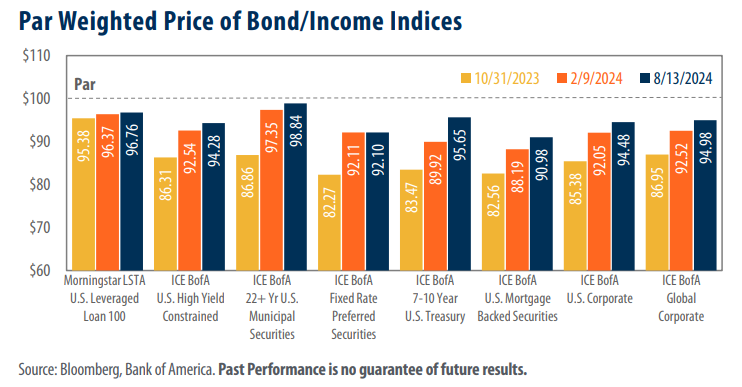

Valuations for seven of the eight bond indices in today’s chart have improved since our last post, and all eight are significantly above their time series lows from October 2023.

In our last post on this topic, we wrote that the increased likelihood of cuts to the federal funds target rate led to a surge in fixed income valuations (fixed income yields and prices generally move in opposite directions). As indicated in today’s chart, that trend has continued in the months since, albeit with a few headwinds along the way. Notably, the start of the third quarter ushered in renewed concerns that the U.S. could fall into an economic recession. In the past two weeks economic reports have included a decline in construction, slower job growth, and mixed ISM indexes, according to Brian Wesbury, Chief Economist at First Trust Portfolios, LP. Should a recession become a reality, we expect the Federal Reserve would have no choice but to lower interest rates, which could increase fixed income valuations further.

The trailing 12-month rate of change in the Consumer Price Index (CPI) stood at 2.9% as of 7/31/24, down significantly from its most recent peak of 9.1% on 6/30/22.

The decrease in the rate of the CPI continues to be a welcome relief to bond investors and consumers alike. In fact, July’s CPI reading marks the lowest level for the metric since 3/31/21. Following their policy meeting in July 2024, the Fed voted to keep the federal funds target rate unchanged, marking the eighth consecutive meeting with no changes. Inflation’s non-linear decline, combined with mixed economic data has made predicting the timing of the Fed’s cuts incredibly difficult. At the close of 2023, the federal funds rate futures market was pricing in an 84.3% chance that the Fed would cut rates at its policy meeting in March 2024. As we now know, those cuts never materialized. Months later, on 8/13/24, that same market is predicting at least four cuts totaling 108 bps are likely by the Fed’s December 2024 meeting.

Takeaway

Echoing our findings in our last post on this topic, bond valuations have improved dramatically over the past six months. From our perspective, soaring bond prices can be attributed to surging expectations that the Fed could announce multiple interest rate cuts in the near-term. That said, timing the Fed can prove to be a fruitless endeavor, and markets react quickly to ever-changing data. Case-in-point, on 7/31/24, the federal funds rate futures market indicated less than three rate cuts totaling 73 bps were anticipated in 2024. On 8/13/24, not even two weeks later, data showed that more than four cuts totaling 108 bps were expected by year’s end. What should investors make of this data? In our opinion, these short-term fluctuations mask the bigger picture. Over the 30-year period ended 7/31/24, the federal funds target rate (upper bound) averaged 2.57% on a monthly basis, while the CPI averaged 2.5%. Should inflation remain subdued and economic data soften further, the Fed may have significant justification for normalizing the spread between interest rates and inflation over the coming months.