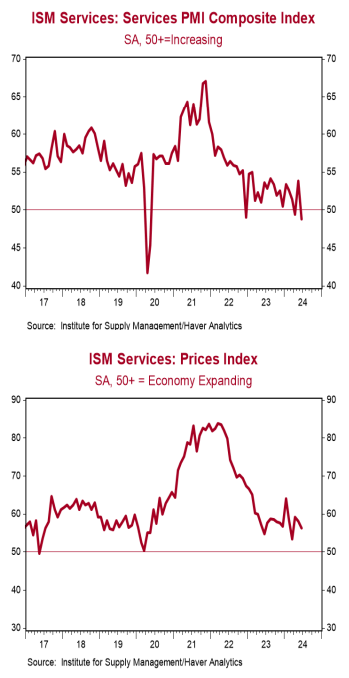

- The ISM Non-Manufacturing index declined to 48.8 in June, well below the consensus expected 52.7. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were all lower in June. The business activity index fell to 49.6 from 61.2, while the new orders index declined to 47.3 from 54.1. The employment index fell to 46.1 from 47.1 and the supplier deliveries index declined to 52.2 from 52.7.

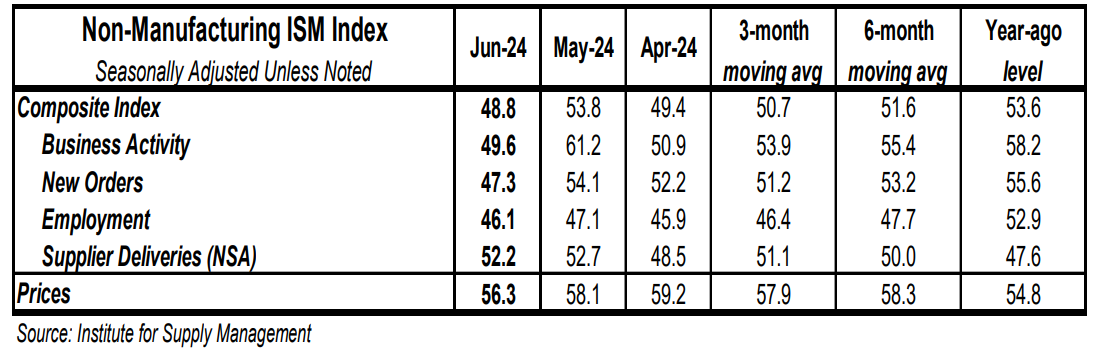

- The prices paid index declined to 56.3 in June from 58.1 in May.

Implications: The ISM Services index surprised sharply to the downside in June, falling to the lowest level in more than four years and – outside of the COVID lockdown months – the lowest since July 2009. With June’s abrupt decline, activity in the U.S. service sector has now contracted in two out of the last three months, adding to the growing pile of evidence that the U.S. economy is running out of steam. Looking at the details of the report, eight out of the eighteen major service industries reported growth for the month while an equal amount reported contraction and two reported no change. The drop in the overall index was a result of much lower business activity in June as well as slower new orders. Notably, both of the indexes for new orders and business activity fell into contraction territory, the first time they have been below 50 since December 2022 and May 2020, respectively. Meanwhile, service hiring remains muted, as the employment index fell deeper into contraction territory to 46.1, the sixth time in the last seven months below 50. Finally, the worst piece of the report came from the highest reading of any category – the prices index – which declined to a still-elevated 56.3 in June. Although the index is lower than the back-breaking pace from 2021-22 – make no mistake – prices are still rising in the service sector and inflation remains a major problem. Notably, the majority of survey comments from June’s report were focused on continued inflation pressures rather than slowing activity or orders. The service sector has been a main driver for stubbornly high inflation this year and – unfortunately for the Fed – it doesn’t seem to be abating. Meanwhile, the service sector – which has been a lifeline for the US economy the last couple years – is starting to crack. How the Federal Reserve responds in the coming months could determine whether we repeat the stagflationary 1970s.