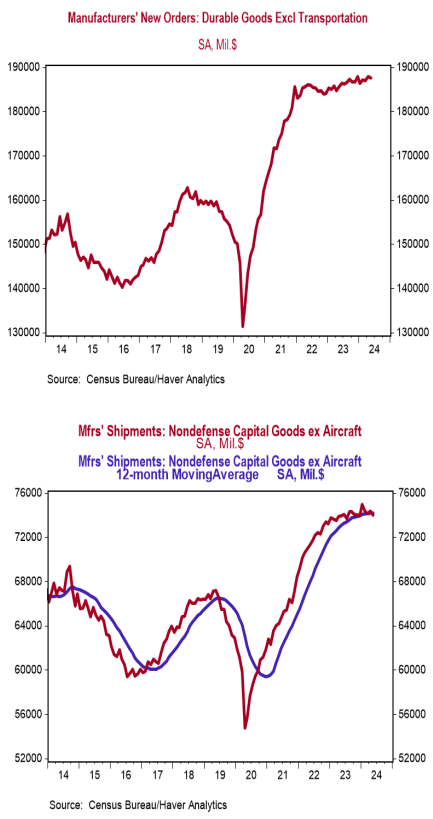

- New orders for durable goods rose 0.1% in May (-0.3% including downward revisions to prior months), beating the consensus expected decline of 0.5%. Orders excluding transportation declined 0.1%, versus a consensus expected +0.2%. Orders are down 1.5% from a year ago, while orders excluding transportation have risen 1.1%.

- Growth in orders for defense aircraft, autos, and fabricated metal products were largely offset by declines in orders for commercial aircraft, machinery, and primary metals.

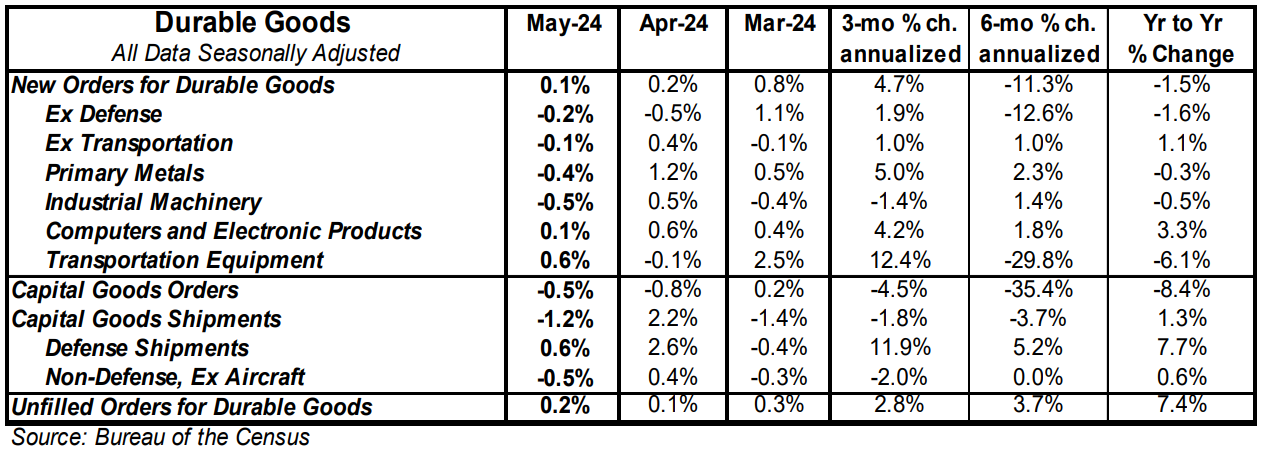

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure declined 0.5% in May. If unchanged in June, these orders would decline at a 1.9% annualized rate in Q2 versus the Q1 average.

- Unfilled orders rose 0.2% in May and are up 7.4% in the past year.

Implications: Durable goods orders inched positive in May, narrowly beating a consensus expected decline. However, the details in today’s report – along with downward revisions to prior data – show a slowing economy. Although orders for durables were up slightly in May they are down 1.5% from a year ago. May orders were led higher by defense aircraft and motor vehicles and parts, up 22.6% and 0.7%, respectively, in May. That said, transportation orders are very volatile month-to-month, and orders declined 0.1% excluding the transportation sector. Looking deeper at the details of the report shows mixed performance across the major non-transportation categories, with orders for machinery (-0.5%), primary metals (-0.4%), and electrical equipment (-0.4%) declining, while fabricated metal products (+0.3%) and computers and electronic products (+0.1%) increased. The most important number in the release, core shipments – a key input for business investment in the calculation of GDP – declined 0.5% in May. If the pace of these shipments remains unchanged in June, core shipments would decline at a 1.9% annualized rate in Q2 versus the Q1 average. The growth in shipments has moderated significantly since surging in 2020 as PPP loans and stimulus payments flooded the system, and shipments fell into contraction in the fourth quarter of 2023 before the rebound last quarter. We expect this trend of turbulent readings to continue as the economy feels the lagged effects of the Federal Reserve’s tightening of monetary policy. In other recent news, initial claims for jobless benefits fell 6,000 last week (possibly held lower by the Juneteenth holiday) to 233,000, while continuing claims rose by 18,000 to 1.839 million. The figures are consistent with continued job gains in June, but at a slowing pace.