View from the Observation Deck

Today’s blog post compares the performance of energy-related stocks to the broader market, as measured by the S&P 500 Index, over an extended period. Given that most developed and developing economies are dependent on oil, natural gas, and electricity for their growth, the prices of those commodities often (but not always) influence the valuations of companies involved in those sectors. Click here to view our last post on this topic.

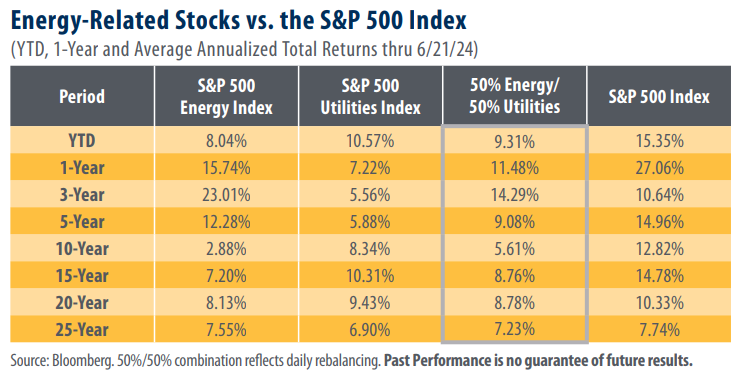

The S&P 500 Energy Index (Energy Index) underperformed the broader S&P 500 Index in seven of the eight time frames represented in today’s table. For comparison, the S&P 500 Utilities Index (Utilities Index) underperformed the S&P 500 Index in all eight of the periods.

In a previous post, we noted that energy company valuations frequently exhibit a high correlation to the price movements of their underlying commodity, while the valuations of utilities companies often fluctuate based on prevailing interest rates. From our perspective, the recent total returns of energy and utility stocks continue to reflect these associations, with some caveats being applied to recent utility valuations. The price of a barrel of WTI crude oil rose by 12.67% YTD through 6/21/24. For comparison, the S&P 500 Energy Index increased by 8.04% on a total return basis over the same period (see table).By contrast, the Utilities Index increased by 10.57% despite no change to the federal funds target rate over the time frame. While it is true that natural gas and electricity prices have increased, surging demand for electricity, resulting from increased usage of Artificial Intelligence (AI) may offer a more compelling explanation for the recent increase in utility stock valuations, in our opinion.

Year-to-date, the Utility Index has outperformed the Energy Index by 253 basis points (see table).

The Utility Index outperformed the Energy Index in three other time frames in today’s table (10-Year, 15-Year, and 20-Year).Year-to-date through 6/21/24, the Utilities Index is the third-best performing sector in the S&P 500 Index, behind the Information Technology and Communication Services Indices, with total returns of 28.79% and 25.10%, respectively. For comparison, with a total return of -7.08%, the Utilities Index was the worst performing sector in the S&P 500 Index in 2023. We think that surging forecasts for electricity demand may explain this dramatic turnaround. In a recent report, Citi Research estimated that the peak utility power demanded by the world’s data centers will rise at a 15% compound annual growth rate from nearly 50 gigawatts in 2023 to over 130 gigawatts in 2030. Processing for AI applications is expected to account for more than 50% of total data center power usage in 2030.

Takeaway

With total returns of -7.08% and -1.42%, respectively, the Utilities and Energy Indices were the only S&P 500 Index sectors to post negative total returns in 2023 (not in table). So far in 2024, they are enjoying a significant turnaround. As of 6/21/24, earnings for the Utilities Index are forecast to increase by 13.41% in 2024, well above the 9.58% earnings growth rate of the broader S&P 500 Index. In our view, the earnings growth expectations of the Utilities Index can be largely attributed to burgeoning demand for electricity to power AI-centric data centers. In addition, most households will keep using their lights, air conditioning, stoves, and furnaces even if budgets are stretched and commodity prices fluctuate. Energy stocks, on the other hand, are forecast to see earnings decline by 5.4% in 2024. One reason for this could be slowing economic activity. In the U.S., real GDP increased at a pace of 1.3% in Q1’24, down from 3.4% in Q4’23. Lower economic activity means fewer deliveries, trips to the store, and travel, which can have a negative effect on the earnings of energy companies.