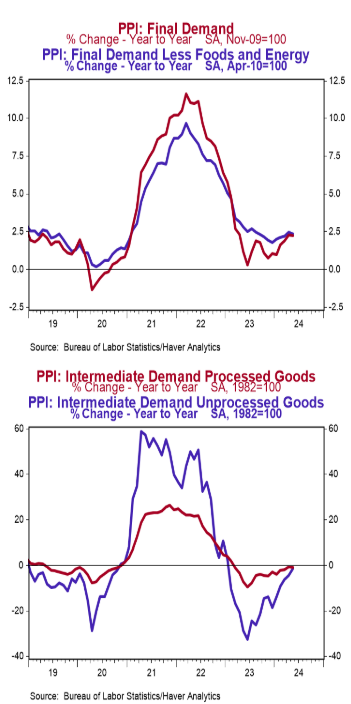

- The Producer Price Index (PPI) declined 0.2% in May, coming in well below the consensus expected rise of 0.1%. Producer prices are up 2.2% versus a year ago.

- Energy prices fell 4.8% in May, while food prices declined 0.1%. Producer prices excluding food and energy were unchanged in May and are up 2.3% versus a year ago.

- In the past year, prices for goods have risen 1.6%, while prices for services have increased 2.6%. Private capital equipment prices declined 0.6% in May but are up 0.8% in the past year.

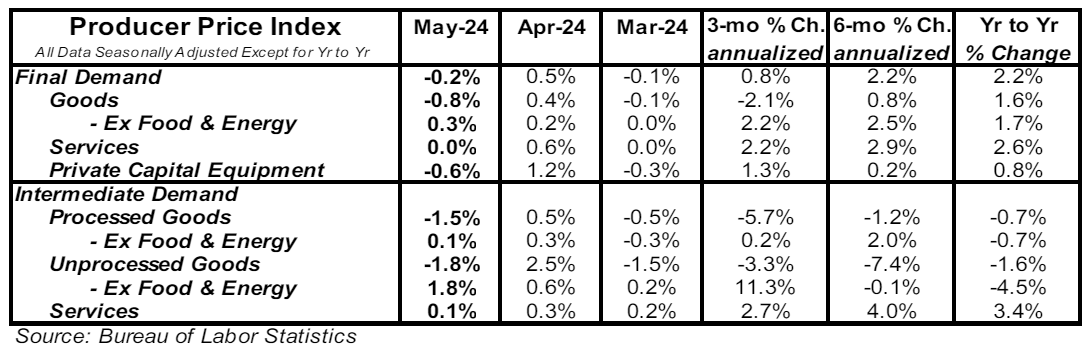

- Prices for intermediate processed goods fell 1.5% in May and are down 0.7% versus a year ago. Prices for intermediate unprocessed goods declined 1.8% in May and are down 1.6% versus a year ago

Implications: Producer prices fell in May at the fastest pace in more than six months as energy costs led the decline. Following an outsized increase in April, producer prices fell 0.2% in May, and have shown significant volatility in the month-to-month readings of late. Through the first five months of the year, producer prices have seen three monthly readings at +0.4% or higher, and two outright declines. Despite the drop in May, producer prices remain up 2.2% in the past twelve months, matching the highest reading in more than a year. Trying to discern a trend in the current environment has proved difficult, leaving the Fed with a lack of confidence in where we go from here, hence the Fed’s downshift in rate cut expectation at yesterday’s meetings (for our takeaways on yesterday’s Fed statement, dot plots, and press conference, click here.) Diving into the May report shows goods costs led the index lower – most notably a 4.8% decline in energy costs – while service prices were unchanged. Falling prices for gasoline (-7.1% in May) accounted for nearly 60% of the goods cost decline, while food prices (-0.1%) also fell. Stripping out the typically volatile food and energy components shows “core” prices were unchanged in May and are up 2.3% in the past twelve months. While that is a slight improvement from the 2.4% year-ago reading in April, core PPI readings have been moving in the wrong direction since breaking below 2% late last year (over the past six months, core producer prices are up 2.8% at an annualized rate). Further back in the supply chain, prices in May fell 1.5% for intermediate demand processed goods and 1.8% for unprocessed goods. Further easing in inflation will come should the Fed have the patience to let tighter monetary policy do its work. But inflation risks re-acceleration should the Fed falter and cut rates too quickly at signs of economic trouble. In other news this morning, initial claims for unemployment insurance rose 13,000 to 242,000 last week, while continuing claims increased 30,000 to 1.820 million. These figures are consistent with continued job growth in June but at a slower pace.