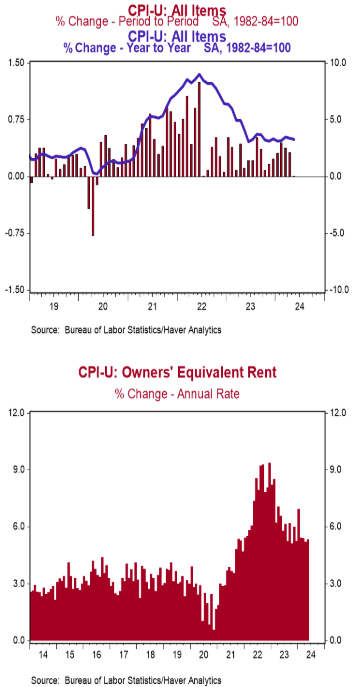

- The Consumer Price Index (CPI) was unchanged in May, below the consensus expected +0.1%. The CPI is up 3.3% from a year ago.

- Energy prices declined 2.0% in May, while food prices rose 0.1%. The “core” CPI, which excludes food and energy, rose 0.2% in May, below the consensus expected +0.3%. Core prices are up 3.4% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – rose 0.5% in May and are up 0.8% in the past year. Real average weekly earnings are up 0.5% in the past year.

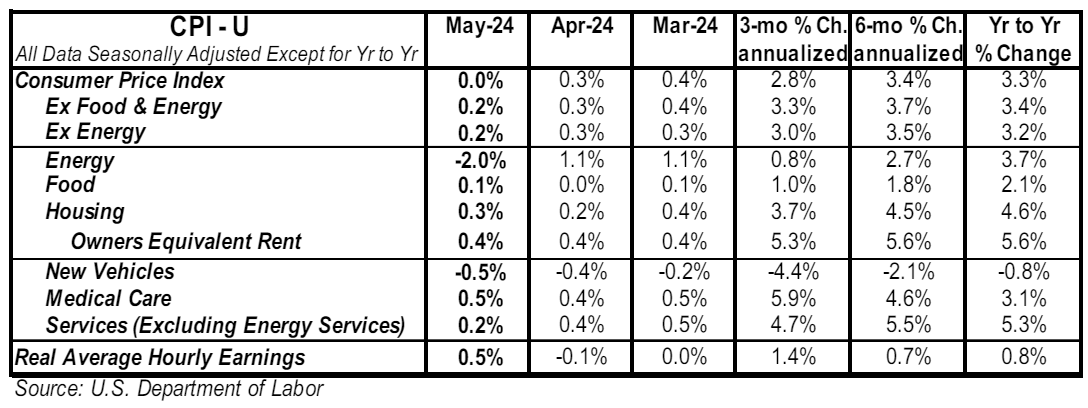

Implications: Inflation came in softer than expected for the second straight month in May, but it’s still far too early before the Fed can declare victory. Looking at the big picture, there was considerable progress against inflation from mid-2022 to mid-2023: consumer prices were up 9.1% in the year ending in June 2022 and then dropped rapidly back to 3.0% in the year ending in June 2023, leading many to believe the end of “temporary” pandemic inflation problems was in sight. But since then, inflation has remained stubbornly above 3%, casting doubt on the Fed’s ability to cut rates in 2024. Looking at the details of today’s report, May inflation was held down by energy prices, which declined 2.0% on the back of lower prices for gasoline (-3.6%). Stripping out energy and its often-volatile counterpart (food), “core” prices also came in softer than expected, rising 0.2% and up 3.4% in the last twelve months. Leading the increase in core prices was once again housing rents – both for actual tenants and the imputed rental value of owner-occupied homes – which continues to defy predictions of imminent reversal, rising 0.4% for the month and running close to or above a 5% annualized rate over three-, six-, and twelve-month timeframes. Housing rents have been a key driver of inflation over the last couple years, a trend we expect to continue as they make up a third of the weighting in the overall index and still haven’t caught up with the rise in home prices in the past four years. Meanwhile, a subset category of prices the Fed has told investors to watch closely and is a useful gauge of inflation in the service sector – known as the “Supercore” – which excludes food, energy, other goods, and housing rents, was unchanged in May. That is the lowest reading since September 2021, a welcome sign for the Fed, as Supercore has showed no sign of abating since the Fed began hiking rates: up 4.8% in the last year and an even faster 5.5% annualized rate over the last six months. While the last two months of inflation data have been “good news” for the Fed, they have repeated they want full confidence that inflation is trending sustainably toward their 2.0% mandate. That likely means several months of cooler readings before they move toward the first rate cut. Moving too soon before the job is done could determine whether we repeat the inflationary 1970s.