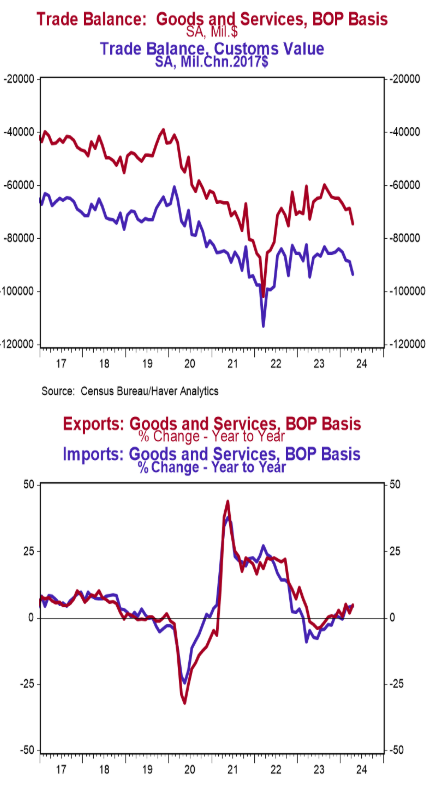

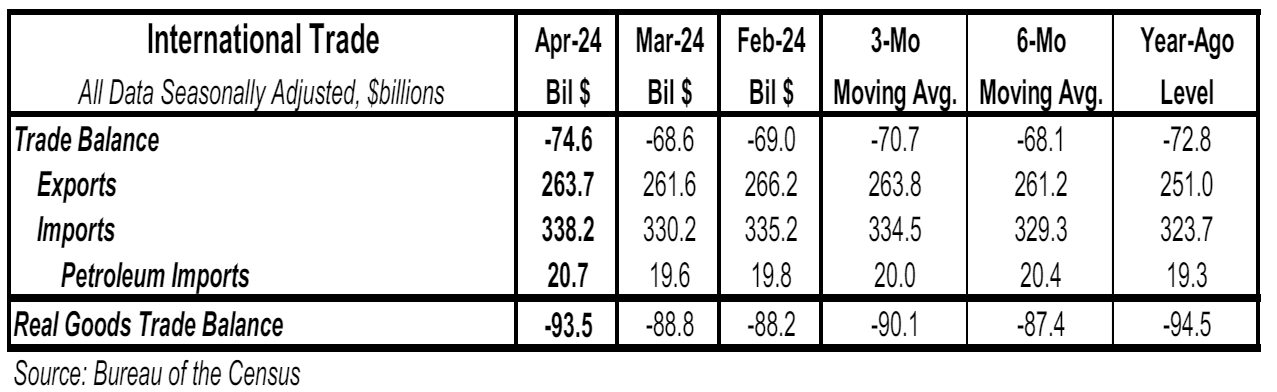

- The trade deficit in goods and services came in at $74.6 billion in April, smaller than the consensus expected $76.5 billion.

- Exports rose by $2.1 billion, led by pharmaceuticals, autos, and electric apparatus. Imports rose by $8.0 billion, led by autos, pharmaceuticals, and computer accessories.

- In the last year, exports are up 5.1% while imports are up 4.5%.

- Compared to a year ago, the monthly trade deficit is $1.8 billion larger; after adjusting for inflation, the “real” trade deficit in goods is $1.0 billion smaller than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications: The trade deficit in goods and services grew to $74.6 billion in April as imports grew much more than exports. However, we prefer to focus on the total volume of trade, imports plus exports, as it shows the extent of business and consumer interaction across the US border. This measure rose substantially in April, growing by $10.1 billion. Total trade volume is up 4.7% from a year ago, with exports up 5.1% and imports up 4.5%. Notably, there is a major shift going on in the pattern of US trade. Through the first four months of the year, imports from China were down 2.6% versus the same period in 2023 and down 27.9% versus the same period in 2022. China used to be the top exporter to the US. Now the top spot is held by Mexico as China has fallen to number three with Canada now in second. Meanwhile, global supply chain pressures have eased substantially over the past few years. This was confirmed by the New York Fed’s Global Supply Chain Pressure Index in April, with the index -0.92 standard deviations below the index’s historical average. For some perspective, two years ago in the month of April the index sat 3.5 standard deviations above the index’s historical average. Expect some temporary volatility though as Yemen’s Houthi rebels continue to deter container ships from transiting the Red Sea and Bab-el-Mandeb Strait, adding volatility to shipping costs. Also in today’s report, the dollar value of US petroleum exports exceeded imports once again. This marks the 23rd consecutive month of the US being a net exporter of petroleum products. In other news today, nonfarm productivity grew at a 0.2% annual rate in the first quarter. Output rose at a 0.9% annual rate while hours worked rose at a 0.6% rate, so output per hour grew slightly. Productivity is up 2.9% from a year ago. Meanwhile, unit labor costs rose at a 4.0% annual rate in Q1 and are up 0.9% from a year ago. Also reported today, initial unemployment claims rose 8,000 last week to 229,000. Continuing claims increased 2,000 to 1.792 million. Plugging this into our models finalizes our forecast for the official nonfarm payroll report for May (to be announced tomorrow morning) at 196,000