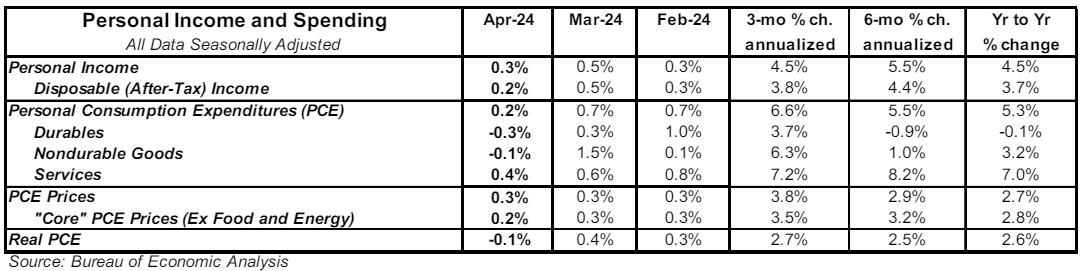

- Personal income rose 0.3% in April (unchanged including downward revisions to prior months), versus a consensus expected 0.3%. Personal consumption rose 0.2% in April (-0.1% including revisions), lagging the consensus expected +0.3%. Personal income is up 4.5% in the past year, while spending has increased 5.3%.

- Disposable personal income (income after taxes) rose 0.2% in April and is up 3.7% from a year ago.

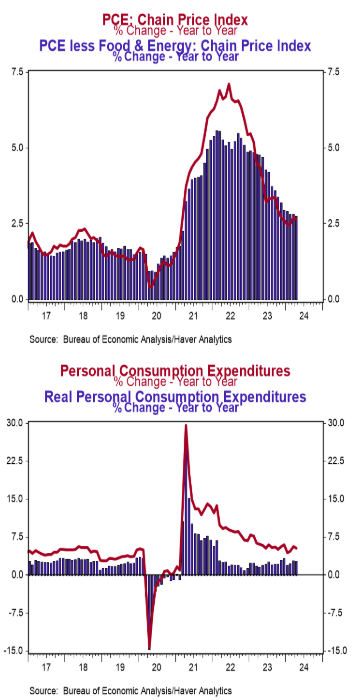

- The overall PCE deflator (consumer prices) rose 0.3% in April and is up 2.7% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.2% in April and is up 2.8% in the past year.

- After adjusting for inflation, “real” consumption declined 0.1% in April but is up 2.6% from a year ago.

Implications: Incomes and spending continued to climb in April, but unfortunately for the Fed, inflation also continues to run hot and has shown acceleration of late. PCE prices – the Federal Reserve’s preferred measure of inflation – rose 0.3% in April, bringing the twelve-month comparison to 2.7%, and has risen at a 3.8% annual rate in the past three months. The Fed – and the markets – have been seeking “confidence” and “evidence” that inflation is sustainably trending toward 2.0% before the Fed starts rate cuts, but today’s report shows that isn’t happening. “Core” prices, which exclude the ever-volatile food and energy categories, rose 0.2% in April and are up 2.8% versus a year ago. The Fed has prioritized a subset of inflation dubbed the “Supercore,” which is services only (no goods), excluding food, energy, and housing. That measure rose 0.3% in April, is up 3.4% versus a year ago, and has remained stubbornly around 3.5% on a year-ago basis for each of the last six months. No matter which measure they choose, or how they try to spin it, inflation remains above the Fed’s target and, given ongoing shipping disruptions in the Red Sea, geopolitical concerns, as well as unexpected events like the bridge collapse near Baltimore earlier this year, there is upside risk in inflation numbers in the months ahead. Transitioning to a focus on how consumers fared in April shows some positive momentum. Personal income rose 0.3% in April and is up 4.5% in the past year. However, the details were not strong. Private-sector wages and salaries rose only 0.2% on the month, although they’re up 4.2% in the past year. Meanwhile, government transfer payments increased 0.3% in April while government pay rose 0.5% and is up 8.6% in the past year, matching the largest twelve-month increase in more than three decades. We don’t think the growth in government pay – or massive government deficit spending – is sustainable or good for the US economy. Consumer spending rose a more modest 0.2% in April, as a rise in outlays on services was partially offset by a pullback in good purchases. And, when adjusting for inflation, consumption declined 0.1%. In other words, consumers spent more on purchases in April, but they ended up buying less than they did in March. We are closely watching the service sector as the driver of consumer activity both now and in the near future, and we expect activity to temper as higher interest rates and continued inflation pressures take their toll. There is a price to pay for the extraordinary stimulus spending in response to COVID. That has come in part in the form of inflation and higher rates, but the letdown from the sugar high is still to be fully felt.