View from the Observation Deck

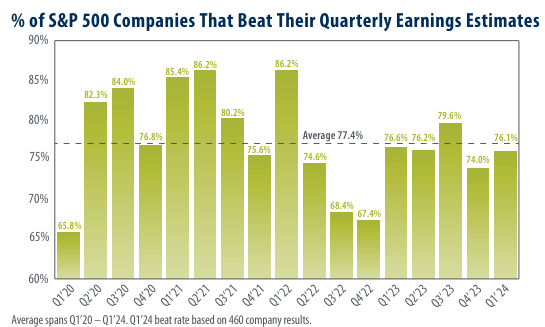

We update this post on an ongoing basis to provide investors with insight into the earnings beat rate for the companies that comprise the S&P 500 Index (“Index”). As many investors may know, equity analysts adjust their corporate earnings estimates higher or lower on an ongoing basis. While these estimates may provide insight into the expected financial performance of a given company, they are not guarantees. From Q1’20 through Q1’24 (the 17 quarters in today’s chart), the average earnings beat rate for the companies that comprise the Index was 77.4%.

As indicated in today’s chart, the percentage of companies in the Index that reported higher than expected earnings in Q1’24 stood 1.3 percentage points below the 4-year average of 77.4%.

The Index’s earnings beat rate outpaced the average in just seven of the 17 quarters represented. More recently, the beat rate missed the average in seven of the past eight consecutive quarters. Keep in mind that the Q1’24 data in the chart reflects earnings results for 460 of the 503 companies that comprise the Index and could change slightly over the coming weeks.

As of 5/14/24, the sectors with the highest earnings beat rates and their percentages were as follows: Information Technology (86.3%); Consumer Staples (86.2%); and Health Care (85.3%), according to S&P Dow Jones Indices. Energy had the lowest beat rate at 56.5%. The Real Estate sector had the highest earnings miss rate (29.0% during the quarter).

Despite lower-than-average earnings beat rates, the Index surged by 13.84% on an average annual total return basis from 12/31/19 to 5/21/24. We see several reasons for this. First (and perhaps most obvious) is that earnings beats are still occurring for the overwhelming majority of companies in the Index. Another is that the Index is enjoying an above average earnings surprise percentage (the difference between actual earnings and estimated earnings). FactSet reported that on aggregate, the actual earnings for the companies that comprise the Index stood 7.5% above their estimates in the first quarter of 2024. For comparison, the metric averaged 6.7% over the past 10-years.

Takeaway

While earnings beats are generally viewed as positive for the overall market, they represent just one piece of an intricate puzzle. As today’s chart reveals, the earnings beat rate for the companies that comprise the S&P 500 Index has been below the average in most of the quarters we presented. Despite this fact, the S&P 500 Index closed at a record 5,321.41 on 5/21/24, representing an increase of 48.77% on a price only basis from its most recent low of 3,577.03 (10/12/22). As we have mentioned previously, we view revenue growth as foundational to growth in earnings. While not in today’s chart, the blended revenue growth rate for the Index stood at 4.2% on 5/17/24, according to FactSet. Barring a significant change in revenue growth rates over the coming weeks, this would mark the fourteenth consecutive quarter of revenue growth for the S&P 500 Index. Notably, the overall blended earnings growth (combines actual results with estimates for companies yet to report) for the companies in the S&P 500 Index stood at 5.7% on a year-over-year (y-o-y) basis in Q1’24. If that figure holds, it will represent the highest quarterly earnings growth rate for the Index since Q2’22.