View from the Observation Deck

As we near the end of the Q1’24 earnings season, we thought it would be timely to provide an update regarding estimated 2024 and 2025 earnings and revenue growth rates for the companies that comprise the S&P 500 Index (“Index”). On May 17, 2024, the Index closed at 5,303.27, representing an increase of 11.18% on a price-only basis from when it stood at 4,769.83 on December 29, 2023, according to data from Bloomberg. For comparison, from 1928-2023 (96 years) the Index posted an average annual total return of 9.56%. In our post on this topic from October 2023 (click here), we wrote that increased revenues could boost earnings and provide the catalyst for higher equity valuations going forward. We believe that the Index’s notable surge over the past months is reflective, in part, of that scenario playing out.

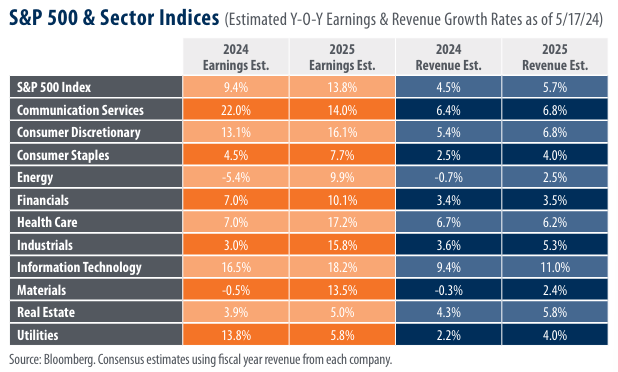

Current estimates reveal favorable earnings growth expectations over the next several years.

As today’s table shows, the earnings for the companies that comprise the S&P 500 Index are expected to increase by a combined 9.4% and 13.8%, respectively, on a year-over-year (y-o-y) basis in 2024 and 2025. These figures are marginally lower than when they stood at 9.5% and 13.9%, respectively, the last time we posted on this topic (click here). Keep in mind that estimates for 2024 reflect favorable comparisons to 2023’s earnings which declined by 0.9% in 2023 (not in table). In 2024, earnings are estimated to decline in just two of the eleven sectors that comprise the Index (Energy and Materials). While negative earnings are never favorable, the Energy and Materials sectors’ 2024 earnings estimates show substantial improvement from our last post, when estimates stood at -6.2% and -4.0% respectively, in 2024.

Revenue growth rate estimates for 2024 and 2025 are also favorable.

As of May 17, 2024, the estimated revenue growth rate for companies in the Index stood at 4.5% and 5.7%, respectively, in 2024 and 2025. These figures are also marginally lower than when they stood at 4.7% and 5.9%, respectively, in 2024 and 2025, the last time we posted on this topic. Nine of the eleven sectors that comprise the S&P 500 Index reflect positive y-o-y revenue growth rate estimates for 2024 with four of them estimated to surpass 5.0%.

Takeaway

As many investors may be aware, equity markets are forward-looking discounting mechanisms. Practically speaking, the price of an efficient market should reflect the sum-effect of present and future (expected) events. We think the recent surge in the S&P 500 Index, which rose by 11.18% (price-only) year-to-date through May 17, 2024, can be explained, in part, by the expected earnings and revenue growth rates revealed in today’s table. Additionally, early-year expectations of multiple cuts to the federal funds rate also played a role in the Index’s growth, in our opinion. That said, information flows quickly, and estimates are subject to constant revision. Time will ultimately reveal the accuracy of these forecasts, but we maintain that higher revenues in the coming years could be the best catalyst for growing earnings, and in turn, higher equity valuations.