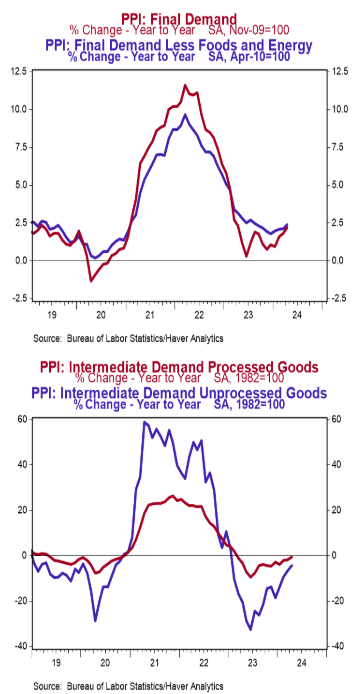

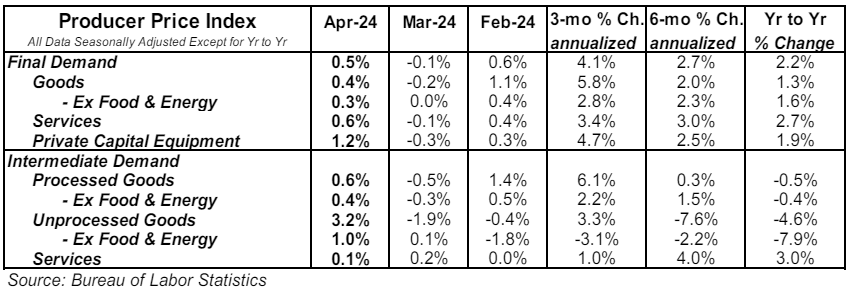

- The Producer Price Index (PPI) rose 0.5% in April, coming in above the consensus expected +0.3%. Producer prices are up 2.2% versus a year ago.

- Energy prices rose 2.0% in April, while food prices declined 0.7%. Producer prices excluding food and energy rose 0.5% in April and are up 2.4% versus a year ago.

- In the past year, prices for goods have risen 1.3%, while prices for services have increased 2.7%. Private capital equipment prices rose 1.2% in April and are up 1.9% in the past year.

- Prices for intermediate processed goods rose 0.6% in April but are down 0.5% versus a year ago. Prices for intermediate unprocessed goods rose 3.2% in April but are down 4.6% versus a year ago.

Implications: April producer prices came in hotter than expected, and certainly higher than what the Fed was hoping to see. Following a breather in March, producer prices rose an outsized 0.5% in April, and have been accelerating of late. Over the last three months, producer prices have risen at a 4.1% annualized pace, while year-ago comparisons are on the rise and now back above 2.0% for the first time since April of last year. While tomorrow’s report on consumer prices will garner more attention, it looks unlikely the Fed is going to feel increased confidence that inflation is moving sustainably toward its 2.0% target. In turn, that means rates are likely to stay higher – for longer – than markets were anticipating earlier this year. Looking at April itself, service costs lead the index higher, rising 0.6% on the month. Prices for services less trade, transportation, and warehousing (+0.6% in April) accounted for more than two-thirds of the services cost increase, while margins to wholesalers rose 0.8%. Goods prices didn’t provide any relief, rising 0.4% in April lead by higher energy costs (+2.0% in April). That said energy prices – along with food prices – tend to be volatile month-to-month, and April was no exception. Stripping out these two components shows “core” prices rose 0.5% in April. Core prices dipped below 2.0% on a year-ago basis back in November of last year, but have turned back higher and are now up 2.4% in the past twelve months. While the Fed can take some solace in that the twelve-month rise in core prices has eased since peaking at 9.7% back in March of 2022, they will be less than enthused about the breach back above 2.0%, nor will they welcome the acceleration over recent months, with core prices up 3.2% annualized in the past three months. Further back in the supply chain, prices in April rose 0.6% for intermediate demand processed goods and 3.2% for unprocessed goods. Further easing in inflation will come should the Fed have the patience to let a tighter monetary policy do its work. But inflation risks re-acceleration should the Fed falter and cut rates too quickly. The question on many minds coming in to 2024 was if the Fed could orchestrate a soft landing, now it’s looking increasingly possible that the Fed may not have clearance to start landing procedures before the year is through.