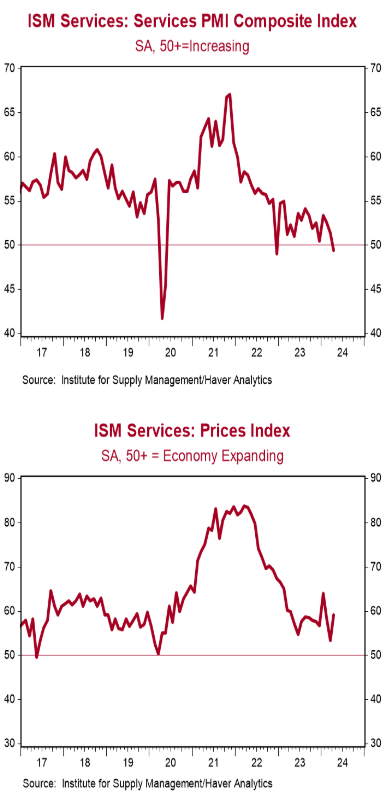

- The ISM Non-Manufacturing index declined to 49.4 in April, well below the consensus expected 52.0. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mostly lower in April. The business activity index dropped to 50.9 from 57.4, while the new orders index fell to 52.2 from 54.4. The employment index declined to 45.9 from 48.5, while the supplier deliveries index rose to 48.5 from 45.4.

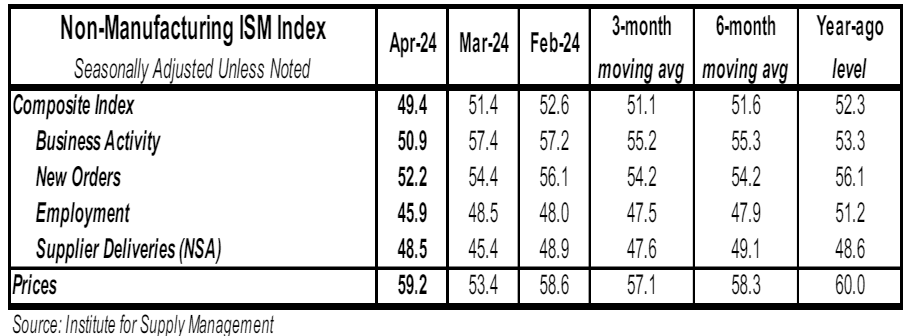

- The prices paid index increased to 59.2 in April from 53.4 in March.

Implications:

The ISM Services index missed consensus expectations and fell into contraction territory for the first time in sixteen months. Although the service sector has not matched the same weakness as the manufacturing sector (which has posted readings below 50 in seventeen of the last eighteen months), activity has been softening lately. Looking at the details of the report, twelve major service industries reported growth in April while six reported contraction. The drop in the overall index was a result of slower growth in business activity and new orders, with those indices declining to 50.9 and 52.2, respectively. Survey comments noted tempered activity coming in part from slowing markets and soft business activity, and in part from concerns over inflation and geopolitical impacts on supply chains. Hiring activity also looks to be cooling, as the index moved deeper into contraction territory in April, now below 50 for four out of the last five months. Although labor tightness remains a key issue for hiring (and with short supply, labor costs have been reported higher for 41 consecutive months), only five major industries reported an increase in employment in April versus ten industries reporting a decline. Inflation remains a major problem. Prices continued to rise in the service sector and the pace accelerated in April. Although the index, which currently sits at 59.2, is below the back-breaking pace from 2021-22, fourteen industries reported paying higher prices in April and not one reported paying lower prices. What do we expect this year? Continued weakening in services activity as the economic morphine from COVID wears off and the impact of the recent reductions in the M2 measure of the money supply make their way through the economy. The service sector was a lifeline for growth in 2023. Further deterioration in this sector could be a harbinger for tougher economic times ahead.