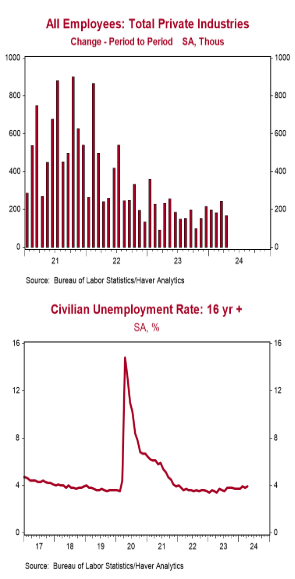

- Nonfarm payrolls increased 175,000 in April, lagging the consensus expected 240,000. Payroll gains for February and March were revised down by a total of 22,000, bringing the net gain, including revisions, to 153,000.

- Private sector payrolls rose 167,000 in April and were revised down by 15,000 in prior months. The largest increase in April was health care & social assistance (+87,000). Government and manufacturing both rose 8,000.

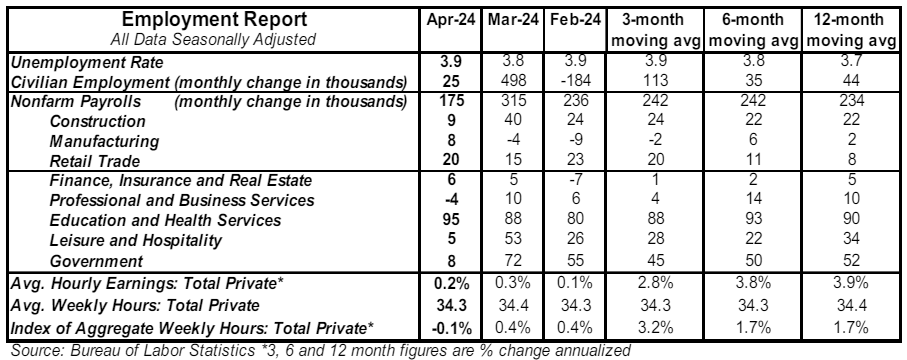

- The unemployment rate ticked up to 3.9% in April from 3.8% in March.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.2% in April and are up 3.9% versus a year ago. Aggregate hours declined 0.1% in April but are up 1.7% from a year ago.

Implications:

The labor market fell short of consensus expectations in April, with slower job growth, slower wage growth, and fewer hours worked. This will not get the Federal Reserve back on track for rate cuts this Summer but could, if followed up with a few months of softer inflation readings, put the Fed in position for a potential rate cut this Fall. Nonfarm payrolls grew 175,000, below the consensus expected 225,000 and the slowest pace for any month so far in 2024. We like to follow payrolls excluding government (because it's not the private sector), education & health services (because it rises for structural and demographic reasons, and usually doesn’t decline even in recession years), and leisure & hospitality (which is still recovering from COVID Lockdowns). That “core” measure of payrolls rose a modest 67,000 in April, also the slowest pace so far this year. Meanwhile civilian employment, an alternative measure of jobs that includes small-business start-ups, increased a modest 25,000. As a result, the unemployment rate ticked up to 3.9% for the month. Much has been written lately about whether the immigration surge at the border is a force behind solid continued job growth. If so, you’d expect job growth in the payroll survey to beat the growth of civilian employment (which is based on a survey of households that probably fails to measure illegal immigrants). That’s consistent with the past year, as payrolls have grown 2.8 million while the employment measure is up only about 500,000. The alternative reason for the general trend of slower employment growth is that this is what sometimes happens when the economy is at a turning point toward a recession. Other tepid news on the job market included a 0.1% decline in total hours worked, and a modest 0.2% increase in average hourly earnings, which are now up 3.9% versus a year ago, the smallest gain since 2021. The Fed will welcome slower growth in wages. The problem for workers is that inflation is running hotter than 0.2% per month, so the most recent gain in wages likely means declining inflation-adjusted purchasing power.