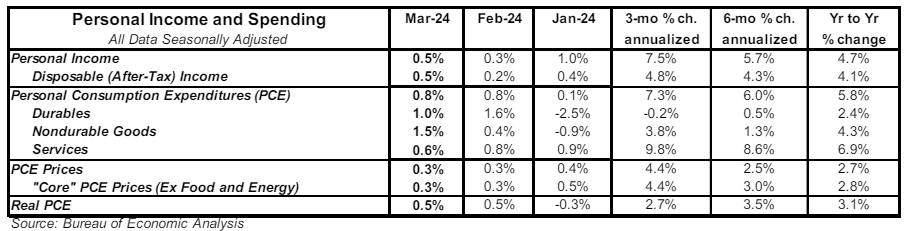

- Personal income rose 0.5% in March (+0.6% including revisions to prior months), matching consensus expectations. Personal consumption rose 0.8% in March, beating the consensus expected +0.6%. Personal income is up 4.7% in the past year, while spending has increased 5.8%.

- Disposable personal income (income after taxes) rose 0.5% in March and is up 4.1% from a year ago.

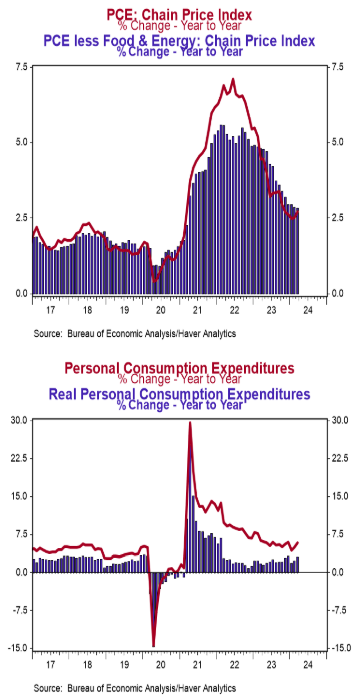

- The overall PCE deflator (consumer prices) rose 0.3% in March and is up 2.7% versus a year ago. The “core” PCE deflator, which excludes food and energy, also rose 0.3% in March and is up 2.8% in the past year.

- After adjusting for inflation, “real” consumption rose 0.5% in March and is up 3.1% from a year ago.

Implications: Incomes and spending rose notably in March, but unfortunately for the Fed, inflation also continues to tick higher. PCE prices – the Federal Reserve’s preferred measure of inflation – rose 0.3% in March, bringing the twelve-month comparison to 2.7% (versus 2.5% last month), and has risen at a 4.4% annual rate over the past three months. If the Fed wants “confidence” and “evidence” that inflation is sustainably trending toward 2.0% before starting rate cuts, today’s report showed quite the opposite. “Core” prices, which exclude the ever-volatile food and energy categories, also rose 0.3% in March and are up 2.8% versus a year ago. The Fed has prioritized a subset of inflation dubbed the “Supercore,” which is services only (no goods), excluding food, energy, and housing. That measure rose 0.4% in March and is up 3.5% versus a year ago (versus 3.4% last month). No matter which measure you choose, they all remain above the Fed’s target and, given ongoing shipping disruptions in the Red Sea, geopolitical concerns, as well as unexpected events like the Francis Scott Key Bridge collapse near Baltimore, there is upside risk in inflation numbers in the months ahead. Looking at consumers shows incomes and spending both accelerating of late. Personal income rose 0.5% in March and is up 4.7% in the past year. Income gains in March were led by private-sector wages and salaries, which rose 0.7% on the month and are up 5.5% in the past year. Meanwhile, and worrisome, government pay rose 0.8% in March and is up 8.5% in the past year, the largest twelve-month increase in more than three decades. We don’t think the growth in government pay is sustainable or good for the overall US economy. Consumer spending rose a robust 0.8% in March, with rising spending on both goods and services. The 1.3% gain in goods purchases was the largest single monthly gain since January of last year, as consumers picked up spending on gasoline, food, and recreational goods. Spending on goods is up 3.6% in the past year. Spending on services rose 0.6% in March – led by health care and housing services – and are up 6.9% in the past year. Expect services to continue to lead the charge in 2024, but with growth tempering as the economy slows. In other recent news on the housing front, pending home sales, which are contracts on existing homes, rose 3.4% in March following a 1.6% increase in February. Plugging these figures into our model suggests existing home sales, which are counted at closing, will rise modestly in April. On the manufacturing front, the Kansas City Fed Manufacturing Index, a measure of factory activity in that region, fell to -8 in April from -7 in March, following a similar negative reading earlier this week from the Richmond Fed.