View from the Observation Deck

Many investors are likely aware of the indispensable role dividends have played in S&P 500 total returns over time. In fact, dividends accounted for nearly 34% of the total return of the S&P 500 Index (“Index”) from 1940 to 2023. That said, we expect they are also aware of the impact of inflation over time. For today’s post, we set out to determine the extent to which dividend payments have outpaced inflation. The time frame we chose was the 45-year period from 1979 to 2023.

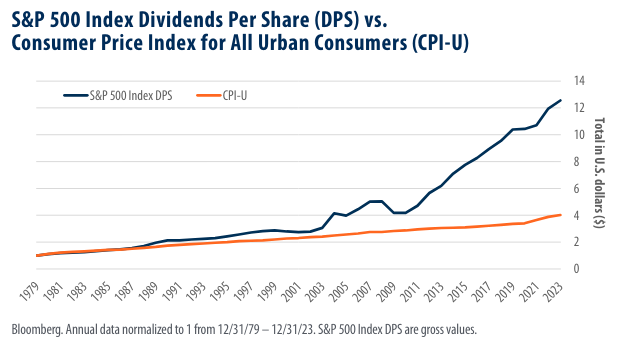

As revealed in the chart above, the dividends per share (DPS) paid by the companies that comprise the Index increased at a staggering pace when compared to the CPI-U.

Over the 45-year period covered by today’s data, the compound annual growth rate (CAGR) of the DPS paid by the companies that comprise the Index stood at 5.78%. For comparison, the CAGR of inflation, as measured by the CPI-U was just 3.13% over the same time frame.

Dividends paid by S&P 500 Index companies reached a record $588.23 billion (preliminary results) in 2023, representing an increase of 4.2% year-over-year from $564.57 billion in 2022, and up 28.9% from $456.31 billion in 2018. Furthermore, the dividend payout ratio for the Index stood at 36.77% on 12/29/23, well below its 30-year average of 45.75% (not in chart).

Despite record high dividend payments, the companies that comprise the Index are paying out a smaller portion of total earnings in the form of dividends than average. From our perspective, companies are more likely to increase or keep dividend distributions steady if earnings are growing. As of 4/19/24, Bloomberg forecast the Index would see earnings growth of 8.81% and 13.64% in 2024 and 2025, respectively.

Takeaway

From 1979 to 2023, the dividends per share paid by the companies that comprise the S&P 500 Index increased at a CAGR of 5.78%. For comparison, the Consumer Price Index for All Urban Consumers increased at a CAGR of 3.13% over the period. While the relationship between dividends and equity returns is generally well understood, we think the data presented today reveals that dividends have provided a powerful offset to inflationary pressures over time.