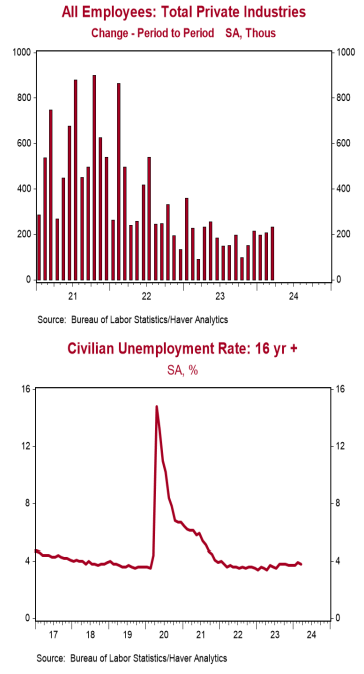

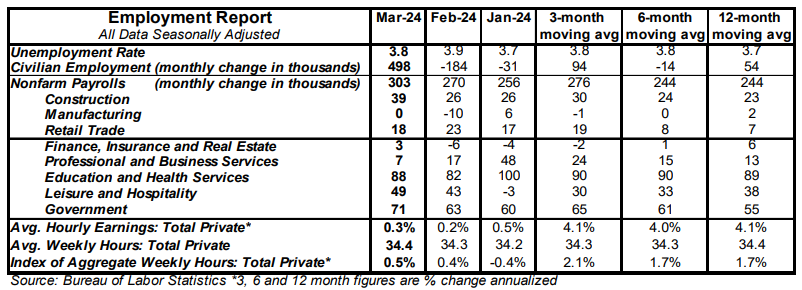

- Nonfarm payrolls increased 303,000 in March, beating the consensus expected 214,000. Payroll gains for January and February were revised up by a total of 22,000, bringing the net gain, including revisions, to 325,000.

- Private sector payrolls rose 232,000 in March and were revised up by 3,000 in prior months. The largest increases in March were health care (+72,000) and leisure & hospitality (+49,000). Government rose 71,000 while manufacturing was unchanged.

- The unemployment rate ticked down to 3.8% in March from 3.9% in February.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.3% in March and are up 4.1% versus a year ago. Aggregate hours increased 0.5% in March and are up 1.7% from a year ago.

Implications:

The labor market showed strength in March: good news for workers, but bad news for those hoping for early or more aggressive rate cuts from the Federal Reserve. Nonfarm payrolls rose 303,000 in March, the largest increase in ten months, and were revised up by 22,000 for prior months, bucking the general trend of negative back revisions. Meanwhile civilian employment, an alternative measure of jobs that includes small-business start-ups, increased a robust 498,000 in March. Much has been written lately about whether the immigration surge at the border is a force behind solid continued job growth. If so, you’d expect job growth in the payroll survey to beat the growth of civilian employment (which is based on a survey of households that probably fails to measure illegal immigrants). That didn’t happen in March, when employment growth beat payroll growth, but it is apparent over the past year, as payrolls have grown 2.9 million while the employment measure is up only about 600,000. The alternative reason for the general trend of slower employment growth is that this is what sometimes happens when the economy is at a turning point toward a recession. In the meantime, there was plenty of other good news in March. Average weekly hours increased to 34.4 from 34.3 in February, and total hours worked rose 0.5% for the month. In addition, average hourly earnings increased 0.3% and are up 4.1% in the past year, which is running a little ahead of inflation. The labor force rose 469,000 in March, pushing the participation rate back up to 62.7%. However, not all the news was quite as good. We like to follow payrolls excluding government (because it's not the private sector), education & health services (because it rises for structural and demographic reasons, and usually doesn’t decline even in recession years), and leisure & hospitality (which is still recovering from COVID Lockdowns). That “core” measure of payrolls rose a more modest 95,000 in March and is up only 61,000 per month in the past year. Also, the household survey shows full-time employment down in the past year, which usually only happens in and around recessions. In addition, given the strength in headline overall payrolls, the Fed has to question whether monetary policy is really tight, given also that CPI inflation remains stubbornly above 3.0%. As a result, the Fed could stay higher for longer, which could hurt more when the effects of tighter money eventually bite.