View from the Observation Deck

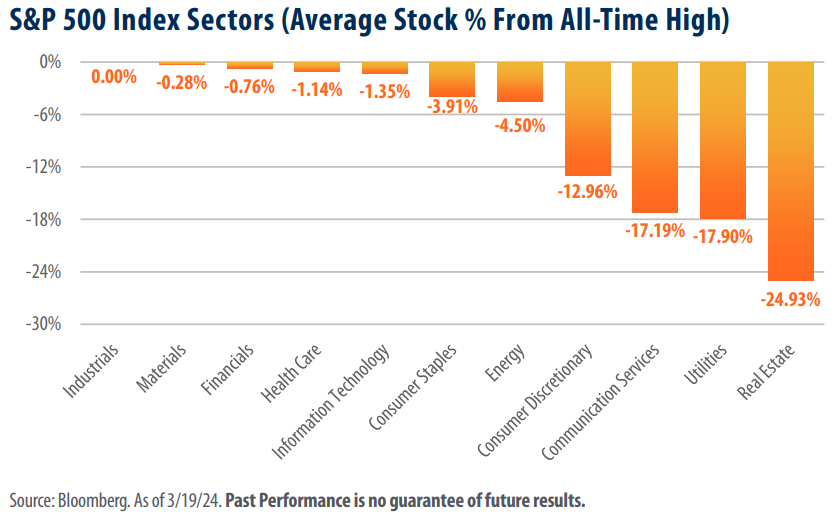

A myriad of factors, including strong earnings growth, developments in Artificial Intelligence (AI), and expectations regarding the direction of U.S monetary policy, sent the S&P 500 Index (“Index”) surging by 9.90% on a total return basis year-to-date (YTD) through 3/20/24. Ten of the eleven sectors that comprise the Index are positive over the same period. The Index closed at a record 5,224.62 on 3/20/24, notching its 19th record high of the calendar year so far. This begs the question: where do each of the eleven sectors stand with regard to their respective all-time highs? As revealed by the chart above, 10 of the 11 sectors that comprise the Index were below their all-time highs as of 3/19/24. That said, four of the 11 sectors (Information Technology, Health Care, Materials, and Industrials) set new all-time highs in 2024.

• Excluding the Industrials sector, which set its all-time high on the day we pulled this dataset, the Materials sector was closest to its all-time high (-0.28%), which was set on 3/13/24. At -24.93%, Real Estate was furthest from its all-time high, which was set on 12/31/21. Communication Services and Information Technology, the two top performing sectors in the Index on a YTD basis thru 3/20/24, stood -17.19% and -1.35%, respectively, below their all-time highs.

• As of 3/19/24, 332 stocks in the S&P 500 Index (currently 503) had positive returns on a price-only basis in 2024, according to data from Bloomberg. Those 332 stocks account for 66.0% of the 503 holdings. For comparison, just 145 stocks in the Index finished the 2022 with positive price returns.

• A Bloomberg survey of 21 equity strategists found that their average year-end price target for the S&P 500 Index was 4,962 as of 3/19/24, according to its own release. The highest estimate was 5,400, while the lowest was 4,200.

Takeaway

The S&P 500 Index has enjoyed remarkable returns thus far in 2024, rising to new all-time highs on 19 separate occasions (thru 3/20/24). Four of the 11 sectors that comprise the Index set record highs in 2024. In our view, the companies that comprise the S&P 500 Index have been rewarded for their persistent earnings and revenue growth, rapid implementation of new technologies (AI), and the potential for monetary policy to ease in the coming quarters. That said, the most recent Bloomberg survey of equity strategists revealed an average year-end price target of 4,962 for the S&P 500 Index (21 strategists surveyed). The figure represents a decline of 5.03% on a price-only basis from 5,224.62 where the Index stood at the close on 3/20/24. We’ll leave it to the pundits to debate the day-to-day direction of equity markets. From our perspective, investors with a long-term view should take comfort in the fact that given enough time, equity markets have never failed to produce new highs.