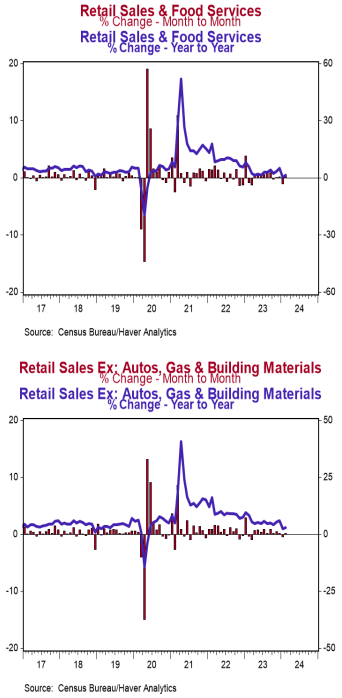

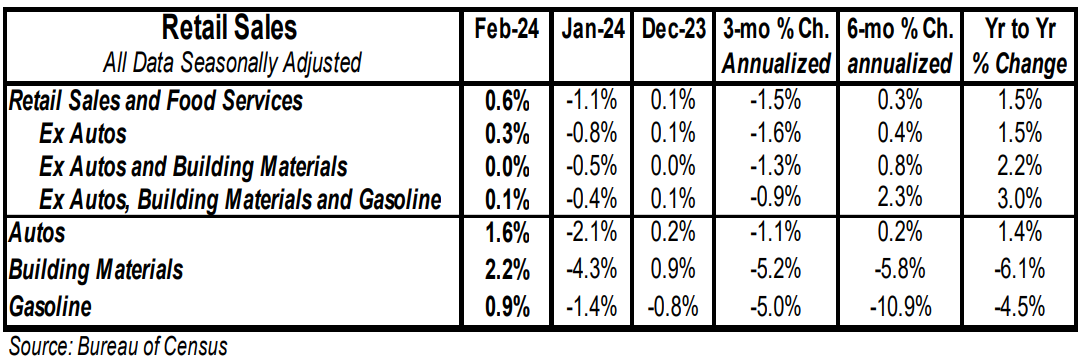

- Retail sales rose 0.6% in February (+0.1% including revisions to prior months), lagging the consensus expected gain of 0.8%. Retail sales are up 1.5% versus a year ago.

- Sales excluding autos rose 0.3% in February (-0.2% including revisions to prior months), lagging the consensus expected gain of 0.5%. These sales are up 1.5% in the past year.

- The largest increases in February were for autos, building materials, and gas stations.

- Sales excluding autos, building materials, and gas rose 0.1% in February but were down 0.5% including revisions to prior months. If unchanged in March, these sales will be down at a 0.7% annual rate in Q1 versus the Q4 average.

Implications: Do not be fooled by the strong headline gain; today’s report was an ugly one on the US consumer. Retail sales rose 0.6% in February – lagging the consensus expected gain of 0.8% – but after factoring in downward revisions to prior months, retail sales rose a tepid 0.1%. Much of the headline gain was driven by auto sales bouncing back after a steep drop in January. Strip that category out, and sales rose 0.3% (but were down 0.2% when including previous months’ revisions). “Core” sales, which exclude volatile categories such as autos, building materials, and gas stations — and is a crucial measure for estimating GDP — increased by 0.1% in February, but was revised significantly lower for previous months, down 0.5%. If unchanged in March these sales will be down at a 0.7% annual rate in the first quarter versus the fourth quarter. That would be the first quarterly decline since the COVID lockdowns. Overall retail sales are up 1.5% in the last year, but down 0.6% since peaking last September, and they are even weaker when factoring in inflation (one of the key drivers of overall spending over the last few years). Real retail sales are down 1.6% in the last year, and have been stagnant for nearly two years since peaking in April 2022. While recent data suggest the goods side of the economy may already be in recession, that cannot be said yet for the services side. However, the category for restaurant & bars – the only glimpse we get at services in the retail sales report – was the main culprit for the substantial downward revisions to prior months; the initial 0.7% gain in January for that category was revised to a 1.0% decline (and prior months were revised lower as well). Factoring in revisions turns February’s 0.4% gain into a 1.9% decline. Putting this altogether, it appears consumers are finally running out of their excess COVID savings, which were boosted by temporary and artificial government stimulus payments in 2020-21 (paid for by money printing). Expect more deterioration in real retail sales into 2024 as higher borrowing costs and a softening labor market take their toll. In employment news this morning, initial claims for jobless benefits declined by 1,000 last week to 209,000, while continuing claims rose by 17,000 to 1.811 million. These figures suggest continued job growth in February.