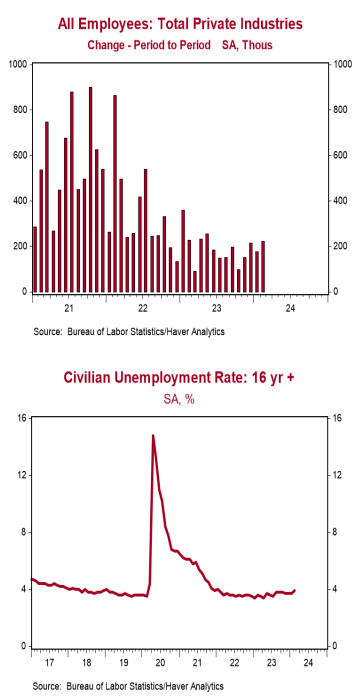

- Nonfarm payrolls increased 275,000 in February, beating the consensus expected 200,000. Payroll gains for December and January were revised down by a total of 167,000, bringing the net gain, including revisions, to 108,000.

- Private sector payrolls rose 223,000 in February but were revised down by 204,000 in prior months. The largest increases in February were health care & social assistance (+91,000) and leisure & hospitality (+58,000). Government rose 52,000 while manufacturing declined 4,000.

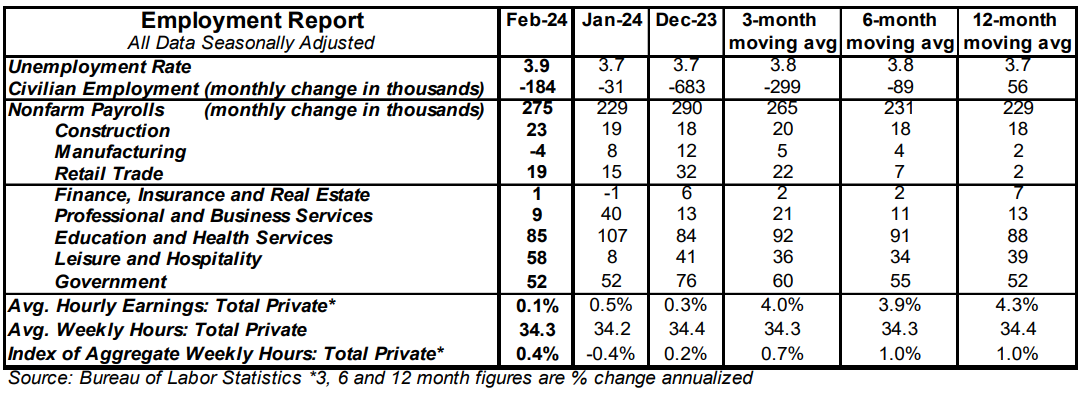

- The unemployment rate rose to 3.9% in February from 3.7% in January.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.1% in February and are up 4.3% versus a year ago. Aggregate hours increased 0.4% in February and are up 1.0% from a year ago.

Implications: Another month with a solid headline gain in payrolls in February, but the details of the report show a murkier situation in the labor market, where not all is well. Nonfarm payrolls rose 275,000 in February, beating the consensus expected 200,000 and higher than the average gain of 229,000 in the past year. So far, so good. But downward revisions to prior months reduced payrolls by 167,000, bringing the net gain to a moderate 108,000. More important: net of revisions, private payrolls rose only 19,000 in February. That’s not a typo; there’s not a zero missing from that number: 19,000. We like to follow payrolls excluding government (because it's not the private sector), education & health services (because it rises for structural and demographic reasons, and usually doesn’t decline even in recession years), and leisure & hospitality (which is still recovering from COVID Lockdowns). That “core” measure of payrolls rose a modest 80,000 in February. Meanwhile, civilian employment, an alternative measure of jobs that includes small-business start-ups, declined by 184,000. In the past, at economic turning points, the civilian employment figure has done a good job of picking up future weakness in payrolls. In the past year, full-time civilian employment is down, while part-time is up, another sign of impending economic weakness. Moreover, on account of the drop in civilian employment, the unemployment rate rose to 3.9% in February, the highest in more than two years, versus 3.7% in January. However, there is good news on the labor market, as well. Total hours worked in the private sector increased 0.4% in February, reversing the decline in January. Hours are up a moderate 1.0% from a year ago. Meanwhile, average hourly earnings rose only 0.1% after a 0.5% surge in January. Average hourly earnings are now up 4.3% versus a year ago. The Federal Reserve will like that a 4.3% gain is slower than the 4.7% gain in the year ending in February 2023 and workers will like that a 4.3% gain is beating consumer prices, which are up 3.1% from a year ago (assuming a 0.4% increase in prices in February). Our view remains that companies have gotten out over their skis in terms of hiring, a recipe for layoffs later in 2024. Total payrolls are up 1.8% in the past year, a pace that would be normal in the middle of an economic expansion when the unemployment rate (and available workers) is much higher than it is today. A weaker job market is heading our way.