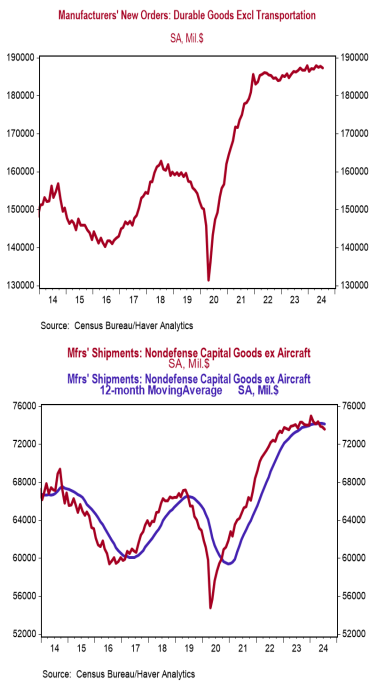

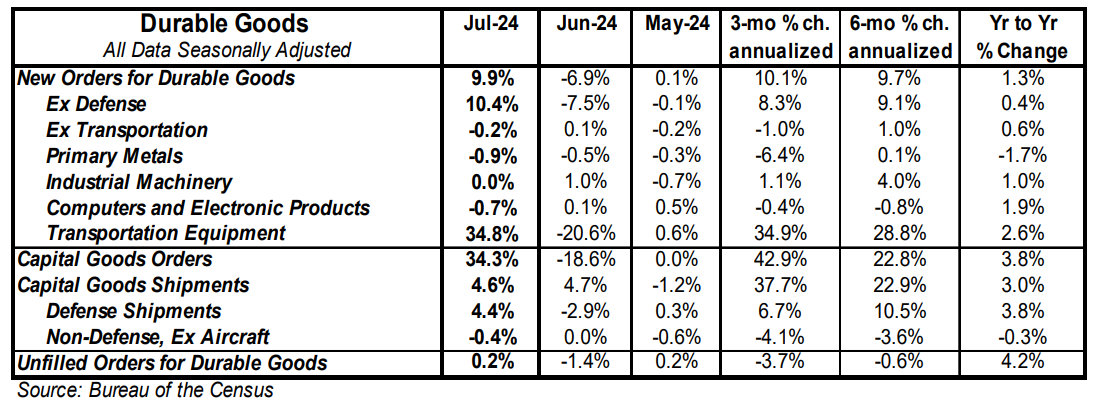

- New orders for durable goods rose 9.9% in July (+9.7% including revisions to prior months), easily beating the consensus expected gain of 5.0%. Orders excluding transportation declined 0.2% (-0.5% including revisions), coming in below the consensus expected -0.1%. Orders are up 1.3% from a year ago, while orders excluding transportation have risen 0.6%.

- Rising orders for commercial aircraft and fabricated metal products were partially offset by a decline in orders for autos, primary metals, and computers & electronic products.

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure declined 0.4% in July. If unchanged in August and September, these orders would decline at a 2.4% annualized rate in Q3 versus the Q2 average.

- Unfilled orders rose 0.2% in July and are up 4.2% in the past year.

Implications: Orders for durable goods surged 9.9% in July, but the gap between this headline and the weaker details of the report was enormous. The 9.9% headline gain was the largest monthly rise since July 2020, but it was all due to extremely volatile aircraft orders, which soared closer to normal after plummeting in June. Excluding the transportation sector, orders for durables declined 0.2% in July, were revised lower for prior months, and are up only a modest 0.6% in the last year, failing to keep pace with inflation. Primary metals led non-transportation orders lower in July, down 0.9% in July, while computers and electronic products (-0.7%), and electrical equipment (-0.4%) also declined. Fabricated metal products (+0.2%) was the lone other category to rise, while machinery orders were unchanged. The most important number in the release, core shipments – a key input for business investment in the calculation of GDP – fell 0.4% in July and, if unchanged in August and September, would decline at a 2.4% annualized rate in Q3 versus the Q2 average, which would match Q2 for the largest single-quarter decline since the COVID shutdowns in 2020. This is the third consecutive month that core shipments have declined, and the fifth time in six months, a clear sign that all is not well on the economic front. Shipments have moderated significantly since surging in late 2020 when PPP loans and stimulus payments flooded the system, and have now declined in two of the last three quarters. While GDP readings continue to run positive, we expect the trend of turbulent readings to continue as the economy feels the lagged effects of the Federal Reserve’s tightening of monetary policy.