View from the Observation Deck

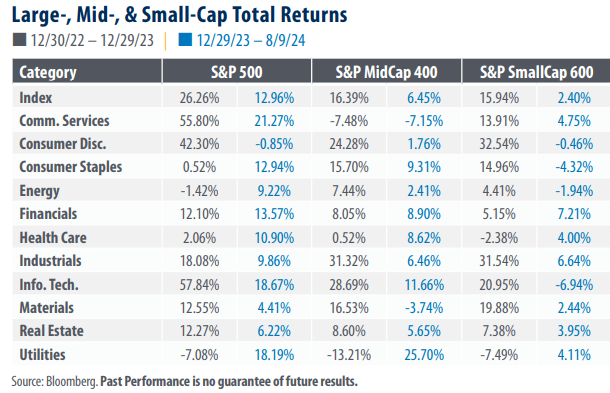

We update today’s table on a regular basis to provide insight into the variability of sector performance by market

capitalization. As of the close on 8/9/24, the S&P 500 Index stood at 5,344.16, 5.70% below its all-time closing high of

5,667.20 set on 7/16/24, according to data from Bloomberg. The S&P MidCap 400 and S&P SmallCap 600 Indices stood

5.76% and 8.85% below their respective all-time highs as of the same date.

- Large-cap stocks, as represented by the S&P 500 Index, posted total returns of 12.96% on a year-to-date (YTD) basis thru 8/9/24, outperforming the S&P MidCap 400 and S&P SmallCap 600 indices, with total returns of 6.45% and 2.40%, respectively, over the period (see table).

- Both the S&P 500 and S&P MidCap 400 Indices crested to new all-time highs in 2024. The S&P SmallCap 600 Index has yet to recapture its pre-COVID high of 1,466.02 set on 11/8/21.

- Sector performance can vary widely by market cap and have a significant impact on overall index returns. Two of the more extreme cases in 2023 were the Communication Services and Technology sectors. In 2024, the Communication Services, Information Technology, and Utilities sectors all exhibit significant variability in performance across market capitalizations.

- Communication Services and Information Technology stocks, the two top-performing sectors in the S&P 500 Index YTD, represented 8.9% and 31.4%, respectively, of the weight of the S&P 500 Index on 7/31/24. By comparison, those sectors represented 1.5% and 8.9% of the S&P MidCap 400 Index, and 2.9% and 12.2% of the S&P SmallCap 600 Index, respectively, as of the same date.

- As of the close on 8/9/24, the trailing 12-month price-to-earnings (P/E) ratios of the three indices in today’s table were as follows: S&P 500 Index P/E: 25.00; S&P MidCap 400 Index P/E: 18.91; S&P SmallCap 600 Index P/E: 19.10.

Takeaway

Both the broader S&P 500 and S&P MidCap 400 Indices reached new all-time highs in July 2024, while the record high for the S&P SmallCap 600 Index occurred nearly three years ago on 11/8/21. Combined, the SmallCap and MidCap Indices comprised just 8.3% of the total market capitalization of the S&P 1500 Index as of 7/31/24. The last time (pre-COVID) that small and mid-sized companies accounted for 8.3% or less of the S&P 1500 Index’s market capitalization was on 4/28/00. Since then, the S&P MidCap 400 and S&P SmallCap 600 Indices notched average annual total returns of 9.25% and 9.32% respectively (4/28/00 thru 8/09/24). For comparison, the average annual total return of the S&P 500 Index was 7.51% over the same period. While past performance is no guarantee of future results, it is our opinion that there may be potential benefits from exposure to small and mid-sized companies going forward.