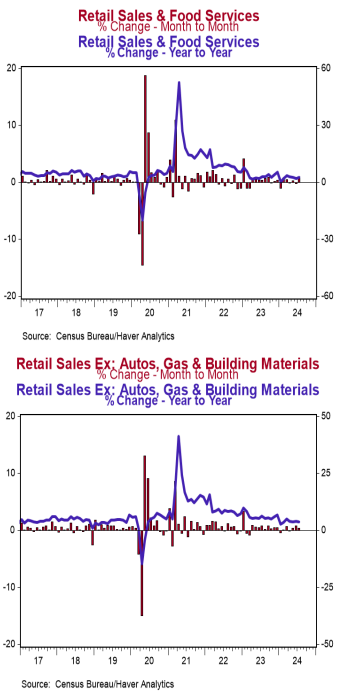

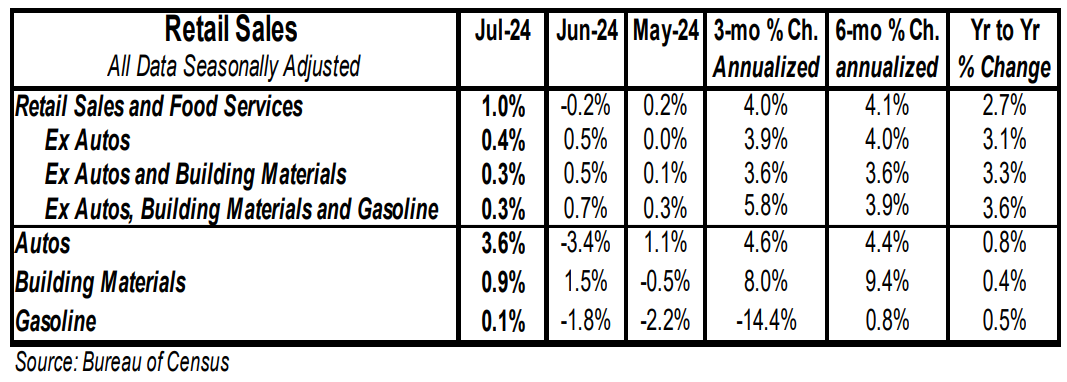

- Retail sales rose 1.0% in July (+0.8% including revisions to prior months), beating the consensus expected gain of 0.4%. Retail sales are up 2.7% versus a year ago.

- Sales excluding autos rose 0.4% in July, beating the consensus expected +0.1%. These sales are up 3.1% in the past year.

- The largest increase in July, by far, was for autos. The largest decline was for miscellaneous store retailers.

- Sales excluding autos, building materials, and gas rose 0.3% in July. If unchanged in August and September, these sales will be up at a 3.8% annual rate in Q3 versus the Q2 average.

Implications: Better than expected, but not as strong as the headline suggests. The U.S. consumer surprised to the upside in July, with retail sales jumping 1.0%. As we wrote earlier this week, much of that was due to a bounce back in auto sales after technology-related snafus at auto-dealers temporarily held down sales in June. Auto sales rose 3.6% in July, the largest gain by far for any major category. Still, stripping out autos, sales rose 0.4% in July, beating the consensus expected gain of 0.1%. The details of the report show that gains were broad-based, with ten out of thirteen major categories rising. Sales at grocery stores (+1.0%), general merchandise stores (+0.5%), and for building materials (+0.9%) were all up notably, although partially offset by a pullback in sales at miscellaneous store retailers (-2.5%). Excluding the volatile categories for autos, gasoline stations, and building materials, “core” sales rose 0.3% in July. Core sales – which are crucial for estimating GDP – were up at a 3.2% annualized rate in the second quarter and would be up at 3.8% annualized rate in the third quarter if unchanged in August and September. What was notably missing from the report was an impact from Amazon Prime Day, which juiced the headline gain last year in July. Nonstore retailers (think internet and mail-order) rose 0.2% in July 2024 versus a 2.2% gain in July 2023. Meanwhile, sales at restaurants and bars – the only glimpse we get at services in the retail sales report – rose 0.3% in July and are up 3.4% in the last year. It looks like sales in this category are starting to slow, with them up at 1.9% and 2.1% annualized rates in the last three and six months, respectively, lagging overall sales. In the last twelve months, overall sales are up 2.7%, which has not kept up with inflation; “real” (inflation-adjusted) retail sales are down 0.3% in the last year and have remained stagnant for three years since peaking in April 2021. This is consistent with our view of a slowing US economy that is starting to feel the lagged impacts from a drop in the M2 measure of the money supply from early 2022 through late 2023. In employment news this morning, initial jobless claims declined 7,000 last week to 227,000. Meanwhile, continuing claims also fell 7,000 to 1.864 million. On the trade front, import prices rose 0.1% in July while export prices rose 0.7%. In the past year, import prices are up 1.6% while export prices are up 1.4%.