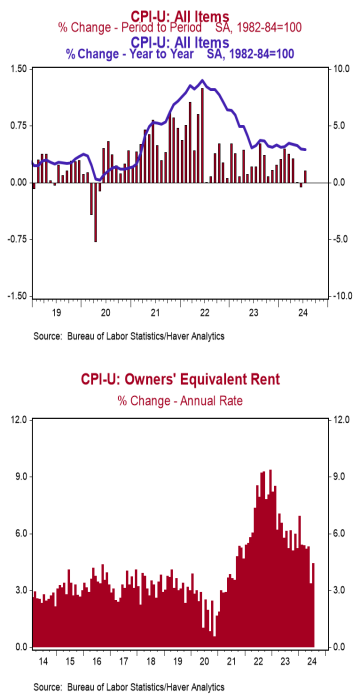

- The Consumer Price Index (CPI) rose 0.2% in July, matching consensus expectations. The CPI is up 2.9% from a year ago.

- Food prices rose 0.2% in July, while energy prices were unchanged. The “core” CPI, which excludes food and energy, rose 0.2% in July, also matching consensus expectations. Core prices are up 3.2% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – rose 0.1% in July and are up 0.7% in the past year. Real average weekly earnings are up 0.4% in the past year.

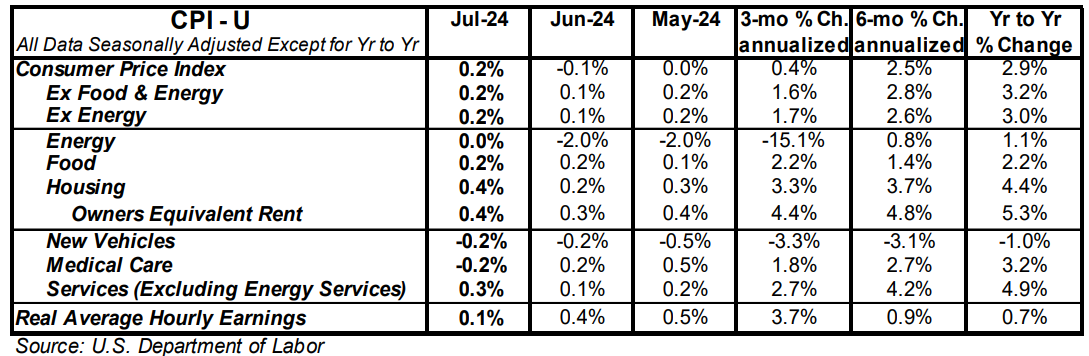

Implications: Inflation matched expectations in July, likely sealing the deal for the start of rate cuts at the Fed’s next meetings in September. After considerable progress against inflation from mid-2022 to mid-2023 (consumer prices peaked at 9.1% in the year ending in June 2022 and then dropped rapidly back to 3.0% in the year ending in June 2023), many believed the end of “temporary” pandemic inflation problems was in sight. But then inflation pressures reignited in the first quarter of 2024, casting doubt on the Fed’s ability to cut rates. Now it appears that inflation has resumed its downward trend; consumer prices are up 2.9% in the last year – the first time below 3.0% since the inflation scare began in early 2021 – and are showing signs of slowing of late, up at a 0.4% annualized rate in the last three months. We have said for some time that easing in inflation will come should the Fed have the resolve to let the lagged effects of tighter monetary policy do its work. Now it finally appears as if the impact from the drop in the M2 measure of money from early 2022 to late 2023 is making its way into the inflation data. Looking at the details of the report, energy prices were unchanged in July after declining 2.0% in both May and June. Stripping that out along with its often-volatile counterpart, food prices (+0.2% for the month), “core” prices also came in line with consensus expectations, rising 0.2%, while the year-ago comparison ticked down to 3.2%. Within the core categories, housing rents (those for actual tenants as well as the imputed rental value of owner-occupied homes) led the way higher once again, increasing 0.4% for the month. Housing rents have been a key driver of inflation over the last couple years and have shown little sign of easing. Their trajectory will have important implications for the future path of inflation as they make up a third of the overall index. Rising prices for rents along with motor vehicle insurance (+1.2% for the month and up 18.6% in the last year) were held down by a handful of declining categories such as medical care (-0.3%), airline fare (-1.6%), used vehicles (-2.3%), and new vehicles (-0.2%). Meanwhile, a subset category of prices the Fed has told investors to watch closely and is a useful gauge of inflation in the service sector – known as the “Supercore” – which excludes food, energy, other goods, and housing rents, rose 0.2% in July. These prices are still up 4.5% in the last year but have showed some signs of slowing, up at a 0.4% annualized pace in the last three months. Although inflation risks are dissipating, we are not at the finish line yet. Inflation is still running above the Fed’s 2.0% target (now for the 41st consecutive month) and could re-accelerate should the Fed overreact and ease policy too much.