View from the Observation Deck

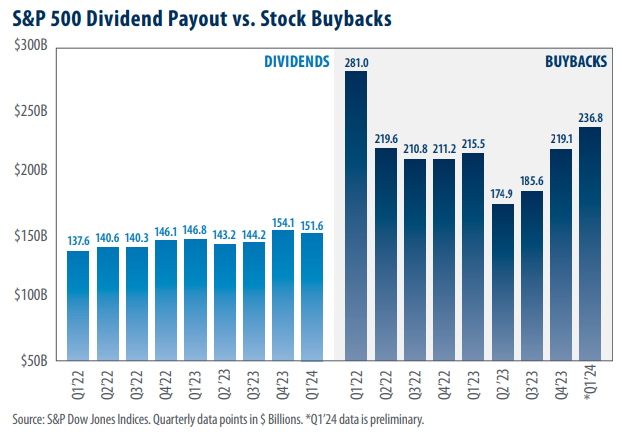

While companies have a number of ways in which to return capital to shareholders, cash dividends and stock buybacks have been increasingly popular methods corporations have utilized in recent years. Apart from Q3’22, Q2’23, and now Q1’24, dividend distributions steadily increased over today’s set of observations. In contrast, share buybacks account for a larger share of total capital disbursements despite greater variance.

• Combined, stock dividends and share buybacks totaled $1.410 trillion (preliminary data) over the trailing 12-month period ended March 2024, down from $1.431 trillion over the same period last year.

• Dividend distributions totaled $151.6 billion in Q1’24, down from a record $154.1 billion in Q4’23. The Q1’24 result represents just the third quarter-over-quarter decline in total dividend distributions for the period presented in today’s chart. In total, the companies that comprise the S&P 500 Index (“Index”) distributed a record $593.1 billion as dividends over the trailing 12-month period ended in March 2024, up from $573.7 billion over the same period last year. For comparison, the previous record was $588.2 billion, which was distributed over the 2023 calendar year.

• Stock buybacks stood at $236.8 billion in Q1’24 (preliminary data), up from $219.1 billion in Q4’23. Stock buybacks totaled $816.5 billion over the trailing 12-month period ended in March 2024, down from $857.2 billion over the same period last year.

• In Q1’24, the S&P 500 Index sectors that were most aggressive in repurchasing their stock were as follows (% of all stocks repurchased): Information Technology (24.2%); Communication Services (19.1%); and Financials (18.2%), according to S&P Dow Jones Indices.

Takeaway

Despite a slight contraction in Q1’24, the Index’s trailing 12-month dividend distributions increased to a record $593.1 billion. Investors often view dividend increases and initiations as signs of financial strength, while cuts and suspensions can be viewed as signs of weakness. Year-to-date through 7/25, there have been nine dividend cuts and zero suspensions in the Index compared to 15 cuts and four suspensions from January through July of last year. Buybacks surged during the quarter, increasing to $236.8 billion, their highest total since the record $281.0 billion in Q1’22. When ranked by total buyback expenditures, the top 20 companies in the Index accounted for 50.9% of all share buybacks in Q1’24, down from 54.1% in the previous quarter. For comparison, the historical average for the metric is 47.5%.