View from the Observation Deck

Investors directing capital into U.S. mutual funds and exchange traded funds (ETFs) continued to favor passive investing over active management for the 12-month period ended 6/30/24.

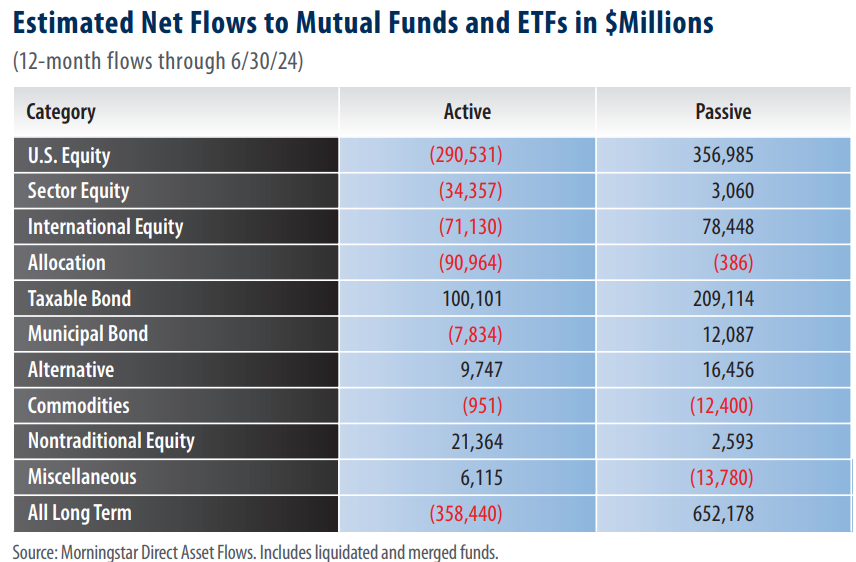

Passive mutual funds and ETFs reported estimated net inflows totaling $652.18 billion for the 12-month period ended 6/30/24, while active funds reported estimated net outflows totaling $358.44 billion over the same period. The top three active categories with net inflows over the past 12 months were Taxable Bonds, Nontraditional Equity, and Alternatives, with inflows of $100.10 billion, $21.36 billion, and $9.75 billion, respectively (see table above). For comparison, the top three passive categories were U.S. Equity, Taxable Bond, and International Equity, with inflows of $356.99 billion, $209.11 billion, and $78.45 billion, respectively.

Despite compelling total returns in the broader equity markets, equity mutual funds and ETFs suffered net outflows over the trailing 12-month period, while fixed income mutual funds and ETFs saw inflows.

Combined, the active and passive equity categories experienced outflows of $24.92 billion for the 12-month period ended 6/30/24. For comparison, the Taxable and Municipal Bond categories reported net inflows totaling $313.47 billion over the same time frame. The S&P 500, S&P MidCap 400, and S&P SmallCap 600 Indices posted total returns of 24.54%, 13.55%, and 8.58%, respectively, for the 12-month period ended 6/28/24, according to data from Bloomberg. With respect to foreign equities, the MSCI Daily Total Return Net World (ex U.S.) and MSCI Emerging Net Total Return Indices posted total returns of 11.22% and 12.55%, respectively, over the same time frame.

Takeaway

Passive mutual funds and ETFs saw inflows of $652.18 billion compared to outflows of $358.44 billion for active funds over the trailing 12-month period ended 6/30/24. In the table above, we observe that the U.S. Equity category experienced the largest disparity, with active shedding $290.53 billion compared to inflows of $356.99 billion for passive funds. Notably, despite compelling total returns in the broader equity markets, equity funds suffered net outflows of $24.92 billion over the trailing 12-month period. For comparison, fixed income saw combined net inflows of $313.47 billion over the same time frame. From our perspective, investor expectations of an impending rate cut could account for the recent surge in fixed income fund flows. Morningstar noted that flows into taxable-bond funds totaled $230 billion during the first half of 2024, representing nearly 87% of all U.S. fund flows over the period. Of that total, $112 billion was allocated to actively managed bond funds.