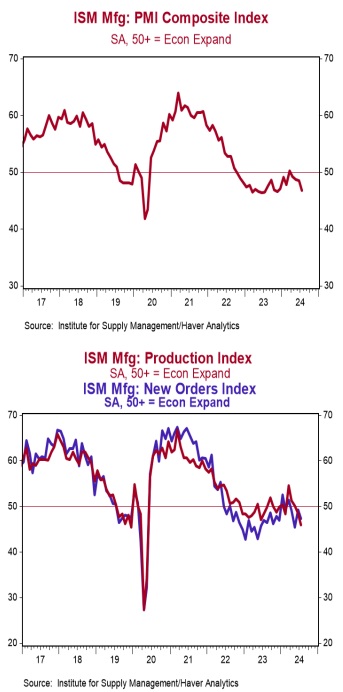

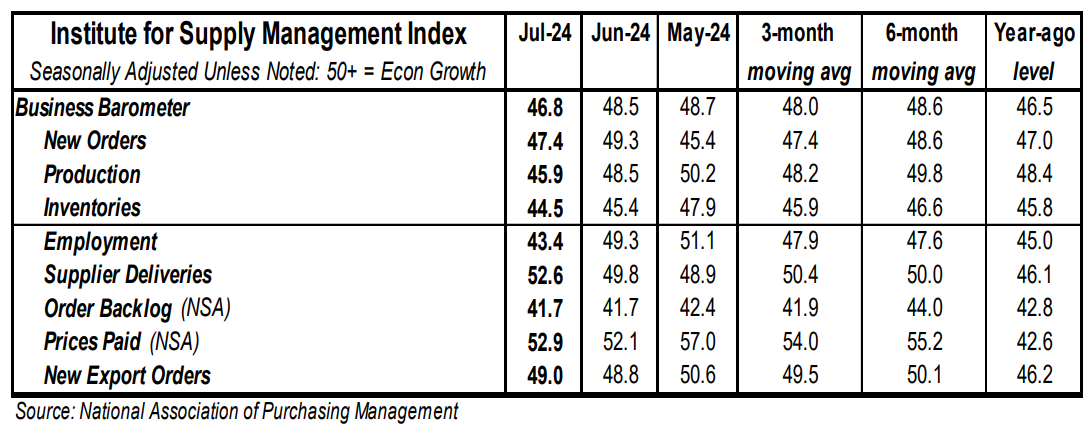

- The ISM Manufacturing Index declined to 46.8 in July, widely lagging the consensus expected 48.8. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mostly lower in July. The production index declined to 45.9 from 48.5 in June, while the new orders index dropped to 47.4 from 49.3. The employment index fell to 43.4 from 49.3 in June, while the supplier deliveries index rose to 52.6 from 49.8.

- The prices paid index rose to 52.9 in July from 52.1 in June.

Implications: Another ugly report on the US manufacturing sector as the ISM Manufacturing index missed consensus expectations once again in July, falling to an eight-month low of 46.8. Activity has now contracted for twenty out of the last twenty-one months. Looking at the details of the report, just five of the eighteen major manufacturing industries reported growth, with eleven reporting contraction, and two reporting no change. Both output and demand contributed to the drop in the overall index, as the production index fell to 45.9 – the lowest level since the COVID Lockdown months – while the new orders index fell further into contraction territory to 47.4, marking the twenty-first month in the last twenty-three where the index has been below 50. Given weak demand, companies have turned to reducing their order backlog. That index, which remained deep in contraction territory at 41.7, has stayed below 50 for twenty-two consecutive months. Survey comments from manufacturing companies have noted dwindling backlogs, which are prompting them to take cost actions. This can be clearly seen in the employment index, which plunged to the lowest level since the COVID Lockdown months at 43.4. Of the eighteen major manufacturing industries, just two reported an increase in employment, while thirteen reported a decline. The weakness seen in the ISM Manufacturing index underpins a growing list of economic data pointing to a slowdown in growth. We expect to see continued manufacturing weakness in the second half of 2024 as the bill for reckless and artificial spending by our government from the COVID years comes due and the lagged impacts from the drop in the M2 measure of the money supply from early 2022 through late 2023 take effect. In other news this morning, construction spending declined 0.3% in June, led by large drops in homebuilding and commercial projects. In recent housing news, the Case-Shiller index increased 0.3% in May and is up 5.9% from a year ago. Meanwhile, the FHFA index was unchanged in May, but is up 5.8% from a year ago. Also on the housing front, pending home sales, which are contracts on existing homes, rose 4.8% in June following a 1.9% decline in May. Plugging these figures into our model suggests existing home sales, which are counted at closing, will rise slightly in July.