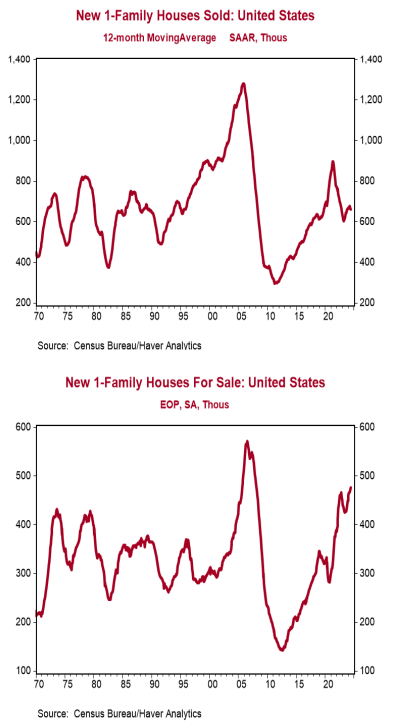

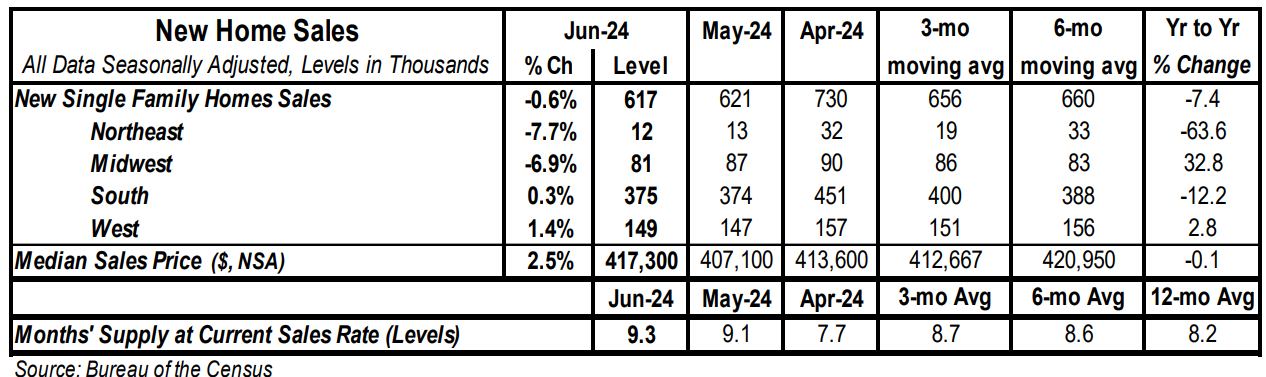

- New single-family home sales declined 0.6% in June to a 0.617 million annual rate, lagging the consensus expected 0.640 million. Sales are down 7.4% from a year ago.

- Sales in June fell in the Midwest and Northeast but rose in the West and South.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) rose to 9.3 in June. The gain was due to both the slower pace of sales and a 4,000 unit increase in inventories.

- The median price of new homes sold was $417,300 in June, down 0.1% from a year ago. The average price of new homes sold was $487,200, down 4.1% versus last year.

Implications: New home sales came in weaker than expected in June, posting another decline following the largest monthly drop since 2022. It looks like activity is stuck in low gear, with sales having normalized roughly at the same pace they were in 2019 before COVID. With 30-year fixed mortgage rates still above 7%, some potential buyers may be delaying purchases in the hopes of widely expected rate cuts from the Federal Reserve improving affordability in the future. Assuming a 20% down payment, the rise in mortgage rates since the Federal Reserve began its current tightening cycle amounts to a 23% increase in monthly payments on a new 30-year mortgage for the median new home. The good news for potential buyers is that the median sales price of new homes has fallen 9.3% from the peak in 2022. It does look like a small part of this decline reflects a lower price per square foot as developers cut prices. The Census Bureau reports that from 2022 to 2023 (the most recent data available) the median price per square foot for single family homes sold fell 1.1%. While that decline is modest, it represents a stark reversal from the 45% gain from 2019 to 2022. That said, most of the drop in median prices is likely due to the mix of homes on the market including more lower priced options as developers complete smaller properties. Supply has also put more downward pressure on median prices for new homes than existing homes. The supply of completed single-family homes is up over 200% versus the bottom in 2022. Total inventories have continued to climb higher as well, hitting a new post-pandemic high in June. This contrasts with the market for existing homes which continues to struggle with an inventory problem, often due to the difficulty of convincing current homeowners to give up the low fixed-rate mortgages they locked-in during the pandemic. Though not a recipe for a significant rebound, more inventories giving potential buyers a wider array of options will keep a floor under new home sales. One problem with assessing housing activity is that the Federal Reserve held interest rates artificially low for more than a decade, and buyers started to believe those low rates were normal. With rates now reflecting true economic fundamentals, the sticker shock on mortgage rates for potential buyers is very real. However, we have had strong housing markets with rates at current levels in the past, and as long as the job market remains strong and buyers understand that the past was a mirage, it’s possible they will eventually adjust. Finally, the Federal Reserve released monthly figures on the money supply yesterday showing M2 rose 0.3% in June and is up 1.0% in the past year. After surging in the first two years of COVID, M2 declined from early 2022 through early 2023 and has since been close to flat. As we mentioned in our recent MMO it looks like this is finally putting downward pressure on both inflation and the growth rate of nominal GDP.