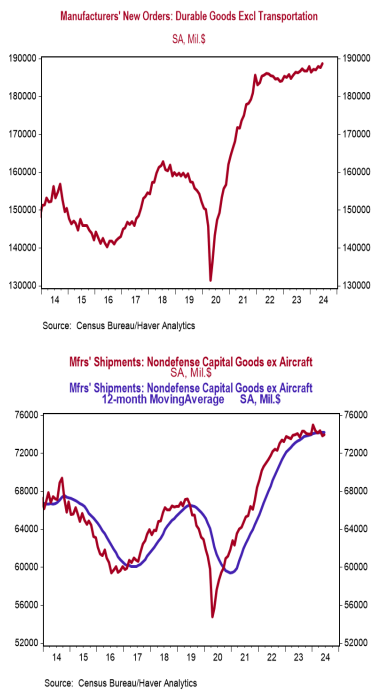

- New orders for durable goods declined 6.6% in June (-6.5% including revisions to prior months), falling well short of the consensus expected rise of 0.3%. Orders excluding transportation rose 0.5%, coming in above the consensus expected +0.2%. Orders are down 10.3% from a year ago, while orders excluding transportation have risen 1.2%.

- Declining orders for commercial and defense aircraft and autos were partially offset by a rise in orders for machinery, computers & electronic products, and communications equipment.

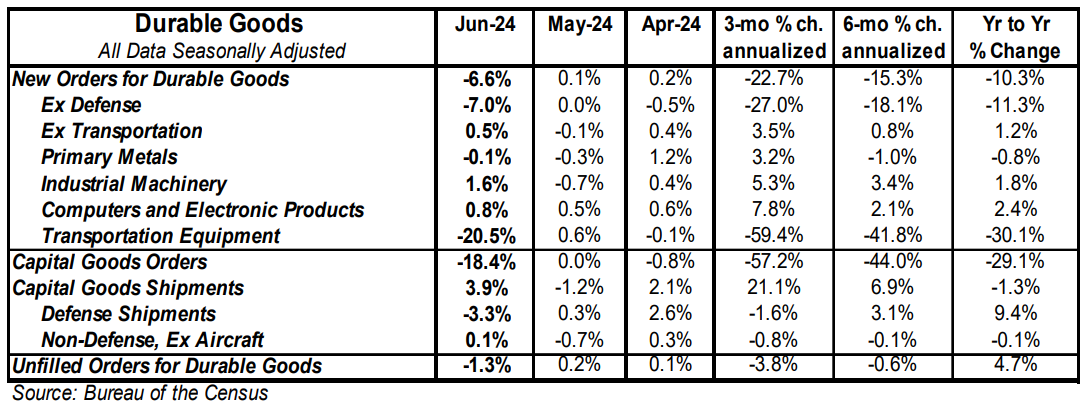

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure rose 0.1% in June but declined at a 2.3% annualized rate in Q2 versus the Q1 average.

- Unfilled orders fell 1.3% in June but are up 4.7% in the past year.

Implications: Orders for durable goods plunged 6.6% in June, the largest monthly decline since the shutdown months of March and April 2020, as transportation orders plummeted. However, the details in today’s report look better than the headline number suggests. Transportation orders, particularly for aircraft, are very volatile month-to-month, and the outsized decline in June is very likely to swing and push orders positive in the months ahead. Strip out the volatile transportation sector, and durable goods orders rose 0.5% in June, beating expectations with most major categories showing gains. Machinery orders led non-transportation orders higher, up 1.6% in June, while electrical equipment (1.3%), computers and electronic products (+0.8%), and fabricated metal products (+0.2%) also rose. Primary metals (-0.1%) were the lone other category to show a decline. The most important number in the release, core shipments – a key input for business investment in the calculation of GDP – rose a modest 0.1% in June but declined at a 2.3% annualized rate in Q2 versus the Q1 average, the largest single-quarter decline since Q2 2020. Shipments have moderated significantly since surging in late 2020 when PPP loans and stimulus payments flooded the system, and have now declined in two of the last three quarters. While GDP readings continue to run positive (see here for today’s report on Q2 GDP), we expect the trend of turbulent readings to continue as the economy feels the lagged effects of the Federal Reserve’s tightening of monetary policy. In other news this morning, initial claims for jobless benefits fell 10,000 last week to 235,000, while continuing claims fell by 9,000 to 1.851 million. The figures are consistent with continued job gains in July, but at a slowing pace.