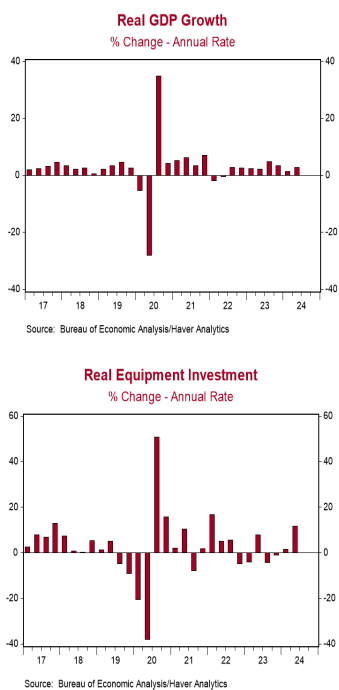

- Real GDP increased at a 2.8% annual rate in Q2, beating the consensus expected 2.0%.

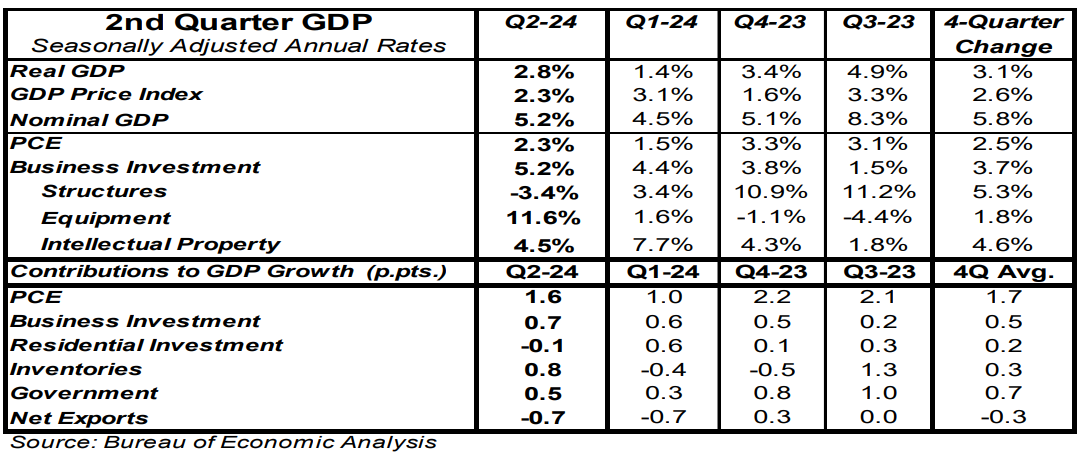

- The largest positive contributions to real GDP growth in Q2 came from personal consumption, inventories, business investment in equipment, and government purchases. The largest drag was net exports.

- Personal consumption, business fixed investment, and home building, combined, rose at a 2.6% annual rate in Q2. We refer to this as “core” GDP.

- The GDP price index increased at a 2.3% annual rate in Q2 and is up 2.6% from a year ago. Nominal GDP (real GDP plus inflation) rose at a 5.2% annual rate in Q2 and is up 5.8% from a year ago.

Implications: There are dark clouds on the horizon for the US economy, but the storm isn’t here yet. Real GDP grew at a 2.8% annual rate in the second quarter, beating the consensus expected 2.0%. Most of the growth was accounted for by an increase in consumer spending, which grew at a 2.3% rate. The largest surprise was a hefty increase in business investment in equipment, which grew at an 11.6% pace (likely AI and chip related), the fastest pace in more than two years. We like to follow “core” GDP, which includes consumer spending, business fixed investment, and home building, while excluding government purchases, inventories, and international trade, the latter of which are very volatile from quarter to quarter. Core GDP increased at a healthy 2.6% rate in Q2 and is up 2.9% from a year ago. However, not all the news was good. Net exports were a 0.7 percentage point drag on the growth rate as imports surged, partially due to some importers trying to get ahead of a possible dockworker strike later this year. In turn, and likely related to the import surge, inventory accumulation added 0.8 percentage points to the real GDP growth rate and that’s unlikely to continue. Meanwhile, inflation has not yet been fully tamed. GDP prices rose at a 2.3% pace in Q2 but were up 2.6% from a year ago. That’s progress from the 3.5% annual increase we were seeing a year ago, but still above the Federal Reserve’s 2.0% target. Nominal GDP – real GDP growth plus inflation – increased at a 5.2% rate in Q2 but is still up 5.8% from a year ago. Because of today’s numbers – moderate economic growth, decelerating inflation – many analysts and investors may think the economy is in the clear, without any trouble ahead. By contrast, we believe the lags between monetary policy and the economy are long and variable and that the tighter monetary policy of the last couple of years has yet to have its full affect.