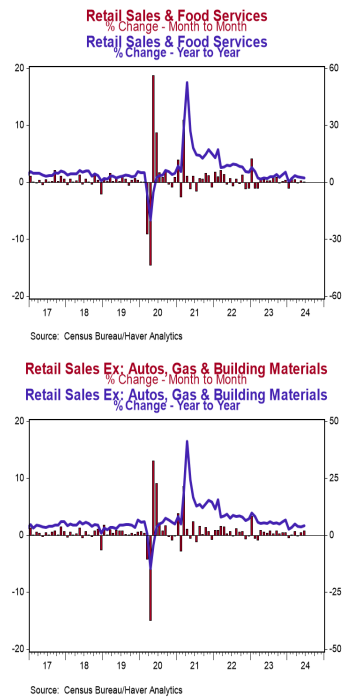

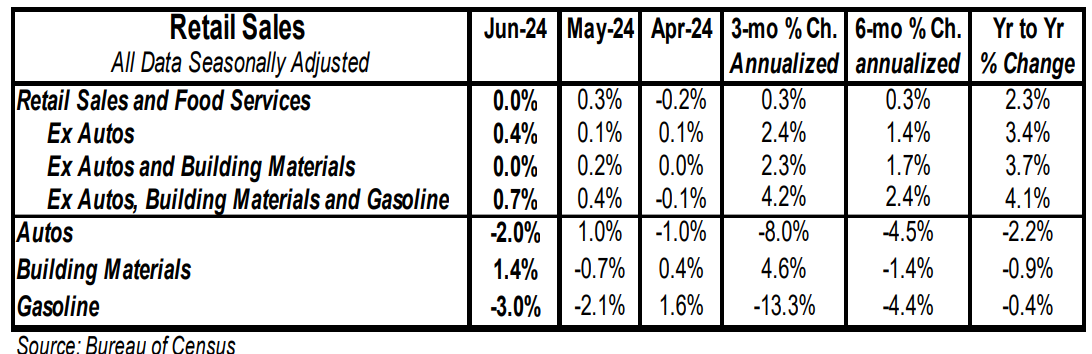

- Retail sales were unchanged in June (+0.2% including revisions to prior months), beating the consensus expected decline of 0.3%. Retail sales are up 2.3% versus a year ago.

- Sales excluding autos rose 0.4% in June (+0.8% including revisions to prior months), beating the consensus expected +0.1%. These sales are up 3.4% in the past year.

- The largest increase in June, by far, was for nonstore retailers (internet and mail-order). The largest declines were for autos and gas stations.

- Sales excluding autos, building materials, and gas rose 0.7% in June and were up 1.2% including revisions to prior months. These sales were up at a 3.4% annual rate in Q2 versus the Q1 average.

Implications: Soft, but stronger than expected. The U.S. consumer closed out the second quarter on the weak side, with retail sales unchanged for the month and up only 2.3% versus a year ago. However, prior months were revised higher and some of the softness in June itself was due to a 2.3% drop at auto dealers, likely stemming from cyberattacks that hit dealerships and which should help boost “pent-up” sales in July. Excluding autos, sales rose 0.4% in June. Looking at the details of the report, ten out of thirteen major categories rose in June, led by a 1.9% jump in sales at nonstore retailers (think internet and mail-order). That was partially offset by a pullback in sales at gas stations as gasoline prices fell. Stripping out gas along with the often-volatile categories for autos and building materials, “core” sales rose 0.7% in June and were up a robust 1.2% when including revisions. Core sales – which are crucial for estimating GDP – were up at a 3.4% annualized rate in the second quarter versus the Q1 average, much better than the 0.7% annualized pace in the first quarter. Meanwhile, sales at restaurants and bars – the only glimpse we get at services in the retail sales report – rose 0.3% in June while previous months activity were revised notably higher. The initial 0.4% decline for that category in May was revised to a 0.4% gain (and prior months were revised higher as well). Factoring in revisions, these sales were up 1.3% in June. In the last twelve months, overall sales are up 2.3%, which has not kept up with inflation; “real” (inflation-adjusted) retail sales are down 0.9% in the last year and have remained stagnant for three years since peaking in April 2021. This is consistent with our view of a slowing US economy as the lagged impacts from the drop in the M2 measure of the money supply from early 2022 through late 2023 take effect. In other news this week, the Empire State Index, a measure of New York factory sentiment, declined to -6.6 in July from -6.0 in June. On the trade front, import prices were unchanged in June while export prices declined 0.5%. In the past year, import prices up 1.6% while export prices are up 0.7%.