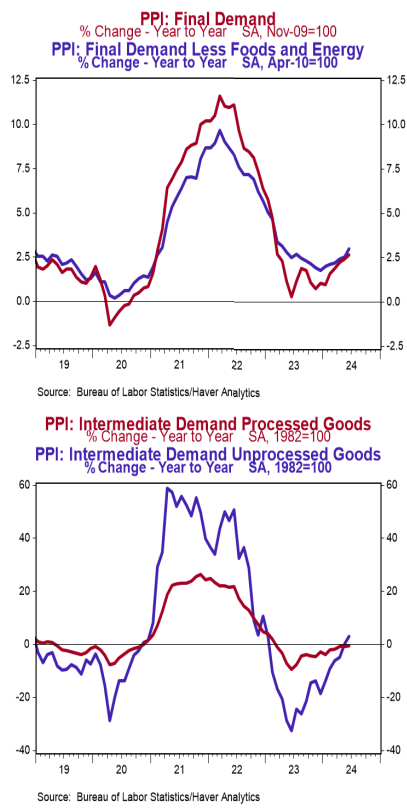

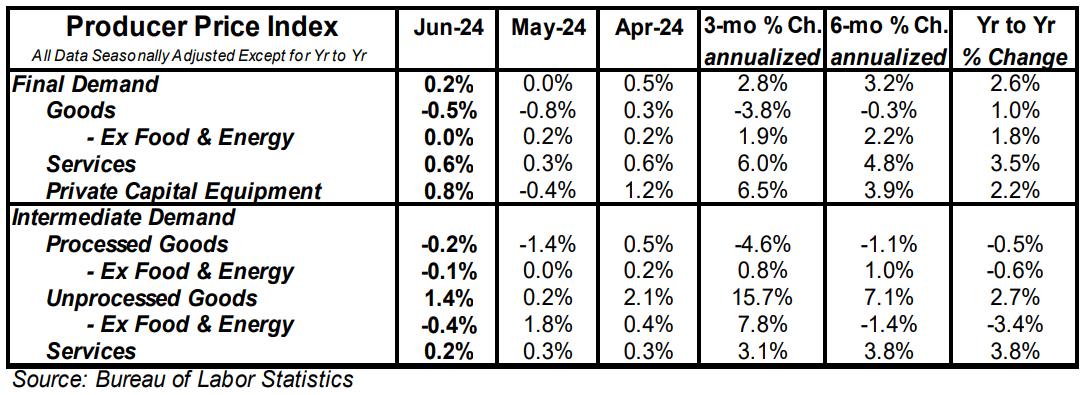

- The Producer Price Index (PPI) rose 0.2% in June, coming in above the consensus expected increase of 0.1%. Producer prices are up 2.6% versus a year ago.

- Energy prices fell 2.6% in June, while food prices declined 0.3%. Producer prices excluding food and energy rose 0.4% in June and are up 3.0% versus a year ago.

- In the past year, prices for goods have risen 1.0%, while prices for services have increased 3.5%. Private capital equipment prices rose 0.8% in June and are up 2.2% in the past year.

- Prices for intermediate processed goods fell 0.2% in June and are down 0.5% versus a year ago. Prices for intermediate unprocessed goods rose 1.4% in June and are up 2.7% versus a year ago.

Implications: Following a breather in May, producer prices were back on the rise in June, cutting a contrast to the consumer price index report out yesterday. Producer prices rose 0.2% in June, are up 2.6% in the past year (the highest twelve month reading since early 2023), and the pace of producer price inflation has accelerated since the start of the year, up at a 3.2% annualized rate over the past six months. The June rise came despite a 2.6% decline in energy prices in June, and a 0.3% drop in food prices. Stripping out these typically volatile food and energy components shows “core” prices jumped 0.4% in June and are up 3.0% in the past year. That also represents the highest twelve month increase in more than a year, and a clear shift from the moderation in producer price inflation in 2022 and 2023. Year-ago comparisons have been moving higher each and every month so far this year, which may serve to give the Fed some pause as they consider the start to rate cuts. Diving into the details of today’s report shows services prices lead the index higher, rising 0.6% in June and up 3.5% in the past year. The June increase was almost entirely attributable to a 1.9% jump in margins received by wholesalers. Goods prices declined in June, led by the aforementioned drop in energy and food prices. The direction of inflation moving forward is very likely to continue being dictated by the services side of the economy, which suffered heavily during the COVID shutdowns but has since returned to the forefront in consumer demand. Further back in the supply chain, prices in June fell 0.2% for intermediate demand processed goods but rose 1.4% for unprocessed goods. We do anticipate easing in inflation will come should the Fed have the patience to let tighter monetary policy do its work, and weakening economic data show higher rates and the delayed impact of the decline in the M2 supply starting to bite. But inflation risks an eventual re-acceleration should the Fed panic and ease policy too quickly at signs of economic trouble.