View from the Observation Deck

We update this post on small-capitalization (cap) stocks every now and then so that investors can see which of the two styles (growth or value) are delivering the better results. Click Here to view our last post on this topic.

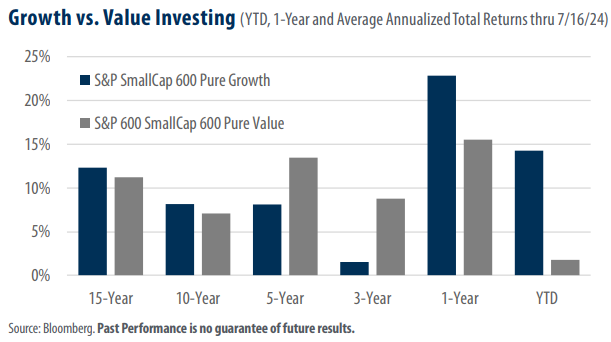

• The S&P SmallCap 600 Pure Growth Index (Pure Growth Index) outperformed the S&P SmallCap 600 Pure Value Index (Pure Value Index) in four of the six time frames covered by today’s chart.

• In our previous post this week, we talked about how sector allocation may have contributed to the performance

delta between large cap growth and value stocks (Click here for that post). That does not seem to be the case here.

• As of 6/28/24, the largest sector in the Pure Growth Index was Consumer Discretionary at 20.0%. The largest

sector in the Pure Value Index was Financials at 20.7% as of the same date.

• The top performing sectors in the S&P SmallCap 600 Index on a trailing 12-month basis and their total return

were as follows: Financials (38.95%), Industrials (32.17%), and Energy (23.74%).

The total returns in today’s chart, thru 7/16/24, were as follows (Pure Growth vs. Pure Value):

• 15-year average annualized (12.33% vs. 11.25%)

• 10-year average annualized (8.18% vs. 7.11%)

• 5-year average annualized (8.13% vs. 13.48%)

• 3-year average annualized (1.52% vs. 8.79%)

• 1-year (22.82% vs. 15.52%)

• YTD (14.28% vs. 1.82%)

Takeaway

As today’s chart illustrates, the Pure Growth Index has enjoyed substantially higher total returns than the Pure Value Index over the trailing 12-month and YTD time frames (thru 7/16/24). Conversely, the Pure Value Index had the better showing over the 3-year and 5-year time periods. The last time we posted about this topic, we presented the idea that sector allocation may have been the differentiator between these two benchmarks. From our perspective, that estimation may no longer hold. What then, could be driving the recent outperformance in small cap pure growth relative to pure value companies? Current Price to Earnings (P/E) multiples may provide insight. At 14.32, the current (as of 7/17/24) P/E ratio for the Pure Growth Index stood well below its 10-year annual average of 22.86. By comparison, the current P/E for the Pure Value Index stood at 17.34 on 7/17/24, also well below its 10-year annual average of 24.86. From our perspective, growth or value, small cap valuations look increasingly attractive in the current environment.