View from the Observation Deck

We update this post every few months so that investors can see which of the two styles (growth or value) are delivering the

better results. Click here to see our last post on this topic.

• We have often noted that value stocks tend to outperform growth stocks when the yield on the benchmark U.S.

10-year Treasury note (T-note) rises and underperform them when the yield on the 10-year T-note falls. The yield

on the 10-year T-note rose by 282 basis points (bps) over the 3-year period ended 7/12/24. For comparison, the

yield on the 10-year T-note declined by 154 bps over the 25-year period ended the same date.

• The most recent increase in the federal funds target rate occurred on 7/26/23. Since then, the consensus has been

that the Federal Reserve (“Fed”) would cut the federal funds target rate multi ple times in 2024; a scenario that has

yet to occur. Perhaps unsurprisingly, the S&P 500 Pure Growth Index (Pure Growth Index) outperformed the S&P 500

Pure Value Index (Pure Value Index) by a significant margin since these rate cut forecasts gained prominence.

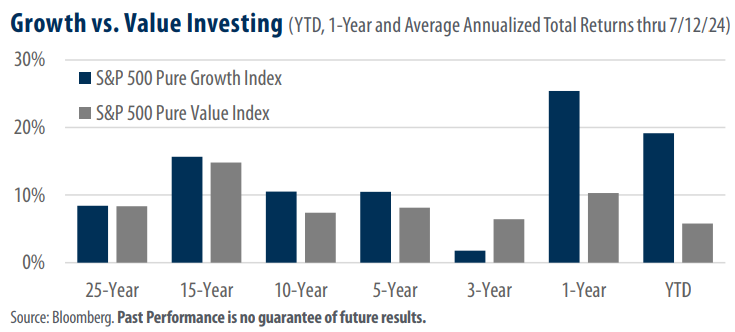

• The total returns in today’s chart are as follows (Pure Growth vs. Pure Value):

25-year avg. annual (8.42% vs 8.33%)

15-year avg. annual (15.67% vs. 14.81%)

10-year avg. annual (10.51% vs. 7.37%)

5-year avg. annual (10.48% vs. 8.13%)

3-year avg. annual (1.75% vs. 6.43%)

1-year (25.39% vs. 10.28%)

YTD (19.14% vs. 5.78%)

• On 6/28/24, Information Technology stocks accounted for 41.3% of the weight of the Pure Growth Index, according to

S&P Dow Jones Indices. At 30.9%, Financials made up the largest weighting in the Pure Value Index as of the same date.

• With a YTD total return of 33.89% (thru 7/12/24), Information Technology was the top performer of the 11 major

sectors in the S&P 500 Index. By comparison, Financials posted a YTD total return of 13.49%.

• The top three performing S&P 500 Index sectors and their YTD total returns (through 7/12/24) are as follows:

Information Technology (33.89%); Communication Services (27.13%); and Utilities (14.38%). As of 6/28/24 those

three sectors comprised a combined 49.8% and 10.7% of the total weighting of the Pure Growth and Pure Value

Indices, respectively

Takeaway

The Pure Growth Index outperformed the Pure Value Index in six of the seven time periods presented

in today’s chart. While this blog post does not account for changes to index constituents over time, it is

notable that Pure Growth’s most recent outperformance appears to be driven largely by sector allocation.

The three top performing S&P 500 sectors YTD account for 49.8% of the weight of the Pure Growth Index

but just 10.7% of the weight of the Pure Value Index. That said, current multiples may signal opportunity

ahead for value-oriented investors. The Pure Value Index had a Price to Earnings (P/E) ratio of 10.48 on

7/15/24, well-below its 20-year average of 18.41. By comparison, the Pure Growth Index had a P/E ratio

of 26.38 at market close on the same date, above its 20-year average of 22.31. Are multiple rate cuts

already priced in the Pure Growth Index, or is there more room to run? Stay tuned!