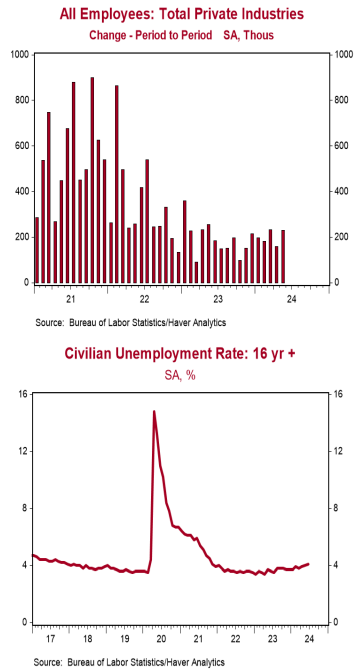

- Nonfarm payrolls increased 206,000 in June, narrowly beating the consensus expected 190,000. Payroll gains for April and May were revised down by a total of 111,000, bringing the net gain, including revisions, to 95,000.

- Private sector payrolls rose 136,000 in June but were revised down by 86,000 in prior months. The largest increase in May was health care & social assistance (+82,000), followed by construction (+27,000). Government rose 70,000 while manufacturing declined 8,000.

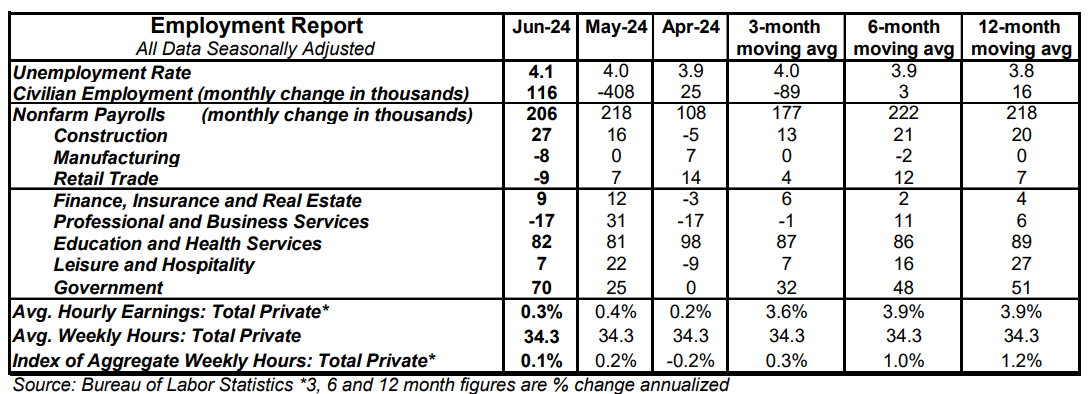

- The unemployment rate ticked up to 4.1% in June from 4.0% in May.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.3% in June and are up 3.9% versus a year ago. Aggregate hours increased 0.1% in June and are up 1.2% from a year ago.

Implications: In spite of the headline payroll increase of 206,000 in June, there are clear signs the job market is decelerating. Revisions for prior months subtracted 111,000 from recent payroll gains. In the private sector, payrolls rose 136,000 in June itself but were revised down by 86,000 in prior months, bringing the net gain to 50,000. Meanwhile, civilian employment, an alternative measure of jobs that includes small-business start-ups, rose 116,000 in June but is up only a grand total of 195,000 from a year ago. No wonder then that the unemployment rate has crept upward, now at 4.1% versus 3.6% a year ago. Notably, the household survey also shows employment among full-time workers down 1.55 million versus a year ago, with all the household job gains among part-time workers. Another emerging flaw in the labor market is that it’s taking longer for unemployed workers to find new jobs. The median duration of unemployment hit 9.8 weeks in June, the highest since January 2023 and compared to 8.8 weeks a year ago in June 2023. The rise in the amount of time it takes to find a new job is consistent with the recent upward creep in continuing jobless claims. We like to follow payrolls excluding government (because it's not the private sector), education & health services (because it rises for structural and demographic reasons, and usually doesn’t decline even in recession years), and leisure & hospitality (which is still recovering from COVID Lockdowns). That “core” measure of payrolls rose only 47,000 in June, which is slower than the average of roughly 70,000 per month in the first half of the year. The good news for the Federal Reserve (but maybe not workers) is that wage growth continues but at a slower pace. Average hourly earnings increased 0.3% in June and are up 3.9% versus a year ago. Back in June 2023, average hourly earnings were up 4.7% from the prior year. Given a target of 2.0% inflation plus productivity growth of around 1.5% per year, the Fed probably wants to see wage growth in the vicinity of 3.5%, and it’s now getting closer. Unfortunately, we think a monetary policy tight enough for the Fed to reach its inflation goals is likely tight enough to slow the economy further in the months ahead.