View from the Observation Deck

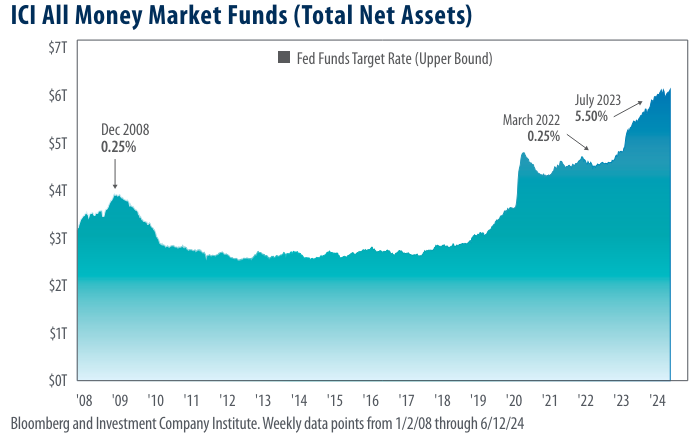

Investors tend to utilize money market funds during times of uncertainty such as the financial crisis in 2008 – 2009, the COVID-19 pandemic of 2020, and the banking crisis in March 2023. Recently, investors have continued to pile cash into money market accounts despite compelling returns in the U.S. equity markets (see chart). A note about the chart: we use the federal funds target rate (upper bound) as a proxy for short-term interest rates, such as those offered by taxable money market funds and other savings vehicles. In our opinion, this proxy may offer insight into the potential effect of short-term rates on investor behavior.

• After growing to an all-time high of $5.98 trillion on 1/10/24 (the last time we posted on this topic), total net assets in U.S. money market accounts increased to a record $6.12 trillion in June 2024.

As of 6/12/24, total net money market fund assets stood at $6.12 trillion, approximately $2.20 trillion, and $1.33 trillion higher than their levels on 1/14/09 (peak during financial crisis) and 5/20/20 (peak during COVID-19 pandemic), respectively.

• From March 2020 to March 2022, the Federal Reserve (“Fed”) kept the federal funds target rate (upper bound) at 0.25%. Since then, the Fed initiated eleven increases to the target rate, raising it from 0.25% to 5.50% where it stands today.

• Inflation, as measured by the 12-month change in the Consumer Price Index, stood at 3.3% on 5/31/24, down only slightly from 3.4% at the end of 2023, but well below its most recent high of 9.1% set in June 2022.

• As of 6/17/24, the federal funds rate futures market was pricing in less than two rate cuts for a total of 45 basis points (bps) in 2024. For comparison, the same market projected more than six rate cuts totaling 158 bps on 12/29/23.

We think that these three factors could account for the recent (post-COVID) surge in U.S. money market account assets shown in the chart. While inflation is still an issue, it has eased from its most recent high. This has led to positive real yields (yield minus inflation) across numerous fixed income classes. We wrote on this topic in August 2023 (click here to read “Finally, a Real Yield”). Moreover, as the likelihood of a late-year rate cut diminishes, so too does the probability that the yield offered by fixed income instruments will suffer a significant downturn in the near-term. The relatively stable net cash flows and high liquidity offered by money market funds have clearly been motivating factors to many investors, in our opinion.

Takeaway

Total net U.S. money market fund assets stood at a record $6.12 trillion on 6/12/24, representing an increase of $1.33 trillion since their peak during the COVID-19 pandemic. In our view, positive real yields brought on by higher interest rates and easing inflation, combined with the decreasing likelihood of multiple rate cuts in 2024, may be driving money market assets higher. We think it is healthy to see real yields trending upward, but investors should be aware that allocations to less-risky assets may come at a cost to positive returns. While money market funds may offer principal stability and income, their total return has lagged the S&P 500 Index, which surged by 26.26% on a total return basis in 2023, and 15.53% year-to-date through 6/17/24. Even accounting for the myriad of short-term risks that currently exist, we believe that an allocation to equities will continue to generate a higher return on capital than cash over time.