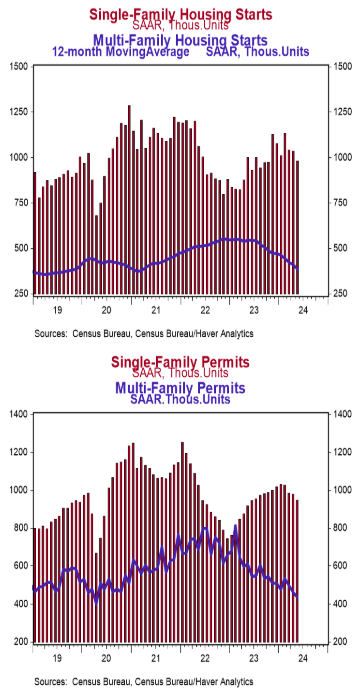

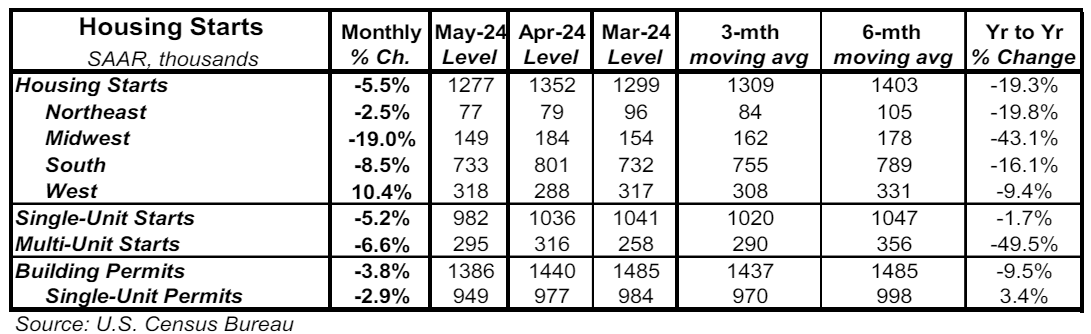

- Housing starts declined 5.5% in May to a 1.277 million annual rate, widely lagging the consensus expected 1.370 million. Starts are down 19.3% versus a year ago.

- The drop in May was due to both single-family and multi-family starts. In the past year, single-family starts are down 1.7% while multi-unit starts are down 49.5%.

- Starts in May fell in the South, Midwest, and Northeast, but rose in the West.

- New building permits declined 3.8% in May to a 1.386 million annual rate, lagging the consensus expected 1.450 million. Compared to a year ago, permits for single-family homes are down 2.9% while permits for multi-unit homes are down 28.8%.

Implications: If you want to know why home prices have remained elevated and rising in most places and rents are still heading up in much of the country, it’s really very easy: we are building too few homes while lax enforcement of immigration laws mean rapid population growth. We think government rules and regulations are likely the major hurdle for builders in much of the country. However, home construction might also be facing headwinds from a low unemployment rate, which makes it hard to find workers, as well as relatively high mortgage rates. Housing starts missed consensus expectations in May by a wide margin and fell to the slowest pace since the worst of the COVID pandemic. This was not due to builders focusing their efforts on completing projects they had already started, as completions fell 8.4% in May. The total number of homes under construction is down 5.1% so far this year, the kind of drop usually associated with a housing bust or a recession. Looking at the details of the report, the drop in activity in May was broad based, with both single-family and multi-family as well as three out of four major regions contributing. Building permits showed similar weakness in May, falling to the lowest level since June 2020. An ongoing theme has been the split between single-family and multi-family development. Over the past year, the number of single-family starts is down 1.7% while multi-unit starts are down 49.5%. Permits for single-family homes are up 3.4% while multi-unit home permits are down 28.8%. Fitting the pattern, the NAHB Housing Index, a measure of homebuilder sentiment, fell to 43 in June from 45 in May. A reading below 50 signals a greater number of builders view conditions as poor versus good. No matter how you slice it, the home building sector seems strangely slow given our population growth and the ongoing need to scrap older homes due to disasters or for knockdowns, which is why we think government rules and regulations are likely a major problem. However, there are some tailwinds for housing, as well. For example, many owners of existing homes are hesitant to list their homes and give up fixed sub-3% mortgage rates, so many prospective buyers will need new builds. In addition, Millennials are now the largest living generation in the US and have begun to enter the housing market in force, which represents a demographic tailwind for activity. In employment news this morning, initial claims for jobless benefits fell 5,000 last week at 238,000, while continuing claims rose by 15,000 to 1.828 million. The figures are consistent with continued job gains in June, but slower than the recent pace. Finally, on the manufacturing front, the Philadelphia Fed Index (a measure of factory sentiment in that region) fell to +1.3 in June from +4.5 in May.