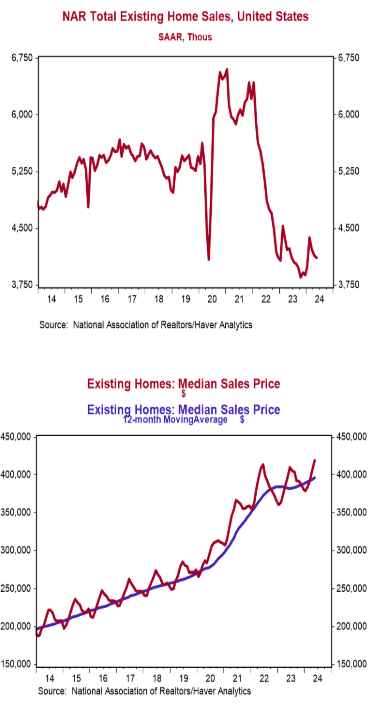

- Existing home sales declined 0.7% in May to a 4.110 million annual rate, narrowly beating the consensus expected 4.100 million. Sales are down 2.8% versus a year ago.

- Sales in May fell in the South, but remained unchanged in the Northeast, Midwest, and West. The drop in May was entirely due to single-family homes. Sales of condos/co-ops were unchanged in May.

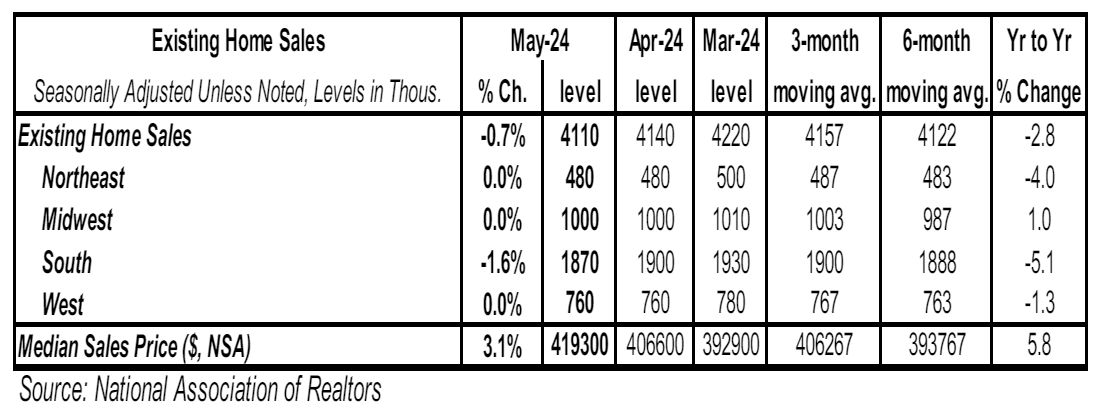

- The median price of an existing home rose to $419,300 in May (not seasonally adjusted) and is up 5.8% versus a year ago.

Implications: There wasn’t much to get excited about in today’s report on existing home sales, with activity falling 0.7% in May, the third decline in a row. It looks like the housing market remains stuck in low gear due to affordability. First, sales are still facing headwinds from mortgage rates that remain above 7%. Second, home prices are rising again (hitting a new high in May) with the median price of an existing home up 5.8% from a year ago. Assuming a 20% down payment, the rise in mortgage rates since the Federal Reserve began its current tightening cycle in March 2022 amounts to a 43% increase in monthly payments on a new 30-year mortgage for the median existing home. Eventually, the housing market can adapt to these increases but continued volatility in financing costs will cause some indigestion. Notably, sales of homes priced at $1 million and above have risen 22.6% in the past year versus a decline of 2.8% for all existing home sales. This demonstrates that, at least at the higher end of the market, both buyers and sellers are adjusting to the new reality of higher rates. That said, outside the most expensive segment many existing homeowners are reluctant to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. This remains a major impediment to activity by limiting future existing sales (and inventories). However, there are signs of progress with inventories rising 18.5% in the past year. That said, the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) was 3.7 in May, well below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. A tight inventory of existing homes means that while the pace of sales looks like 2008, we aren’t seeing that translate to a big decline in prices.