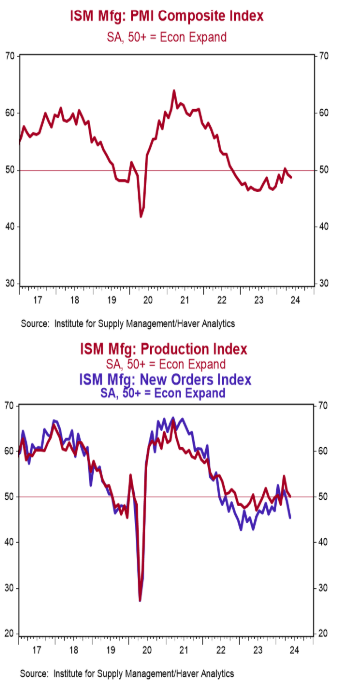

- The ISM Manufacturing Index declined to 48.7 in May, lagging the consensus expected 49.5. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

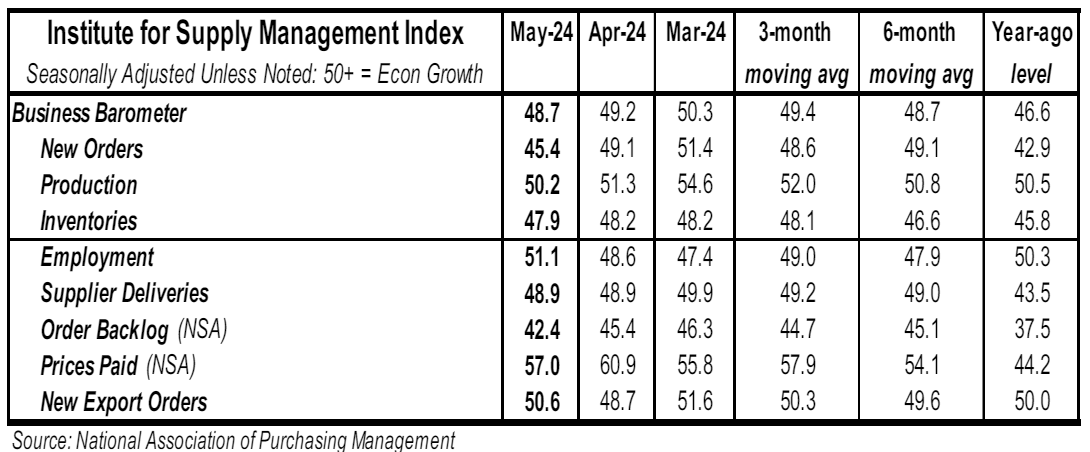

- The major measures of activity were mostly lower in May. The new orders index declined to 45.4 from 49.1 in April and the production index fell to 50.2 from 51.3. The employment index rose to 51.1 from 48.6 in April, while the supplier deliveries index remained at 48.9.

- The prices paid index declined to 57.0 in May from 60.9 in April.

Implications: The ISM Manufacturing index’s brief one-month stint above 50 in March proved to be short-lived, as the index missed consensus expectations once again in May and fell deeper into contraction territory to 48.7. Activity in the US manufacturing sector has now contracted for eighteen out of the last nineteen months. Looking at the details of the report, only seven of the eighteen major manufacturing industries reported growth in May, with the same amount reporting contraction, and four reporting no change. Both demand and production were responsible for the drop in the overall index, as the index for new orders fell to 45.4 and the production index softened to 50.2. This marks the nineteenth month in the last twenty-one where the new orders index has been below 50. With production skating along and demand dragging, companies have turned to reducing their order backlog. That index, which currently sits at 42.4, has been in contraction for twenty consecutive months. Survey comments from manufacturing companies this month warned of dwindling backlogs and have noted that new orders are not coming in as robust as the backlog going down. At some point, something has to give: either new orders pick up, or production falls. We expect the latter. Looking at the big picture, goods-related activity was artificially boosted during the COVID lockdowns, but then the economy reopened, and consumers started shifting their spending preferences back to services and away from goods. The ISM index peaked in the last month federal stimulus checks were sent out (March 2021) and has been weaker ever since. Finally, the worst part of today’s report came from the highest reading of any category – the prices paid index – which declined to a still-elevated 57.0. Inflationary pressures have been on the rise in the manufacturing sector this year, as comments about increasing costs are showing up once again in the report after being absent for most of 2023. This is not a welcome sign for the Fed, as the goods sector was a key driver for lower inflation readings last year. In other news this morning, construction spending declined 0.1% in April, as large drops in healthcare and commercial projects more than offset an increase for manufacturing facilities