View from the Observation Deck

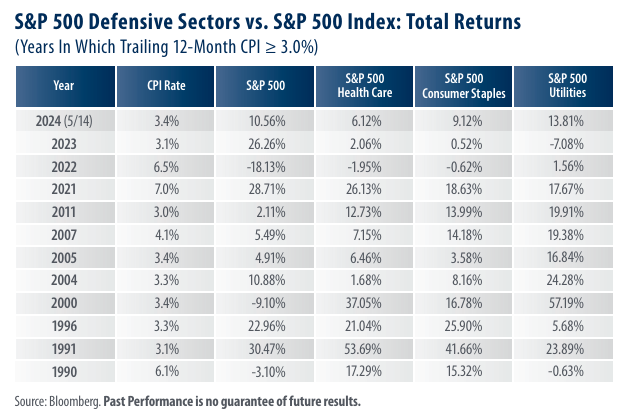

As many investors likely know, given their non-cyclical nature, defensive sectors may offer better performance than their counterparts during periods of heightened volatility. For today’s post, we set out to determine if that outperformance also exists during periods of high inflation. To construct the table above, we started in 1990 and selected calendar years where inflation, as measured by the Consumer Price Index (CPI), increased by 3.0% or more on a trailing 12-month basis. We chose 3.0% as our baseline because the rate of change in the CPI averaged 3.0% from 1926-2023, according to data from the Bureau of Labor Statistics. We then selected three defensive sectors (Health Care, Consumer Staples, and Utilities) and compared their total returns to those of the S&P 500 Index over those periods.

• Of the twelve time frames in the table where inflation increased by 3.0% or more on a trailing 12-month basis, there were only two (2021 and 2023) where the S&P 500 Index outperformed each of the Health Care, Consumer Staples, and Utilities sectors.

• The CPI remains elevated in 2024, and the S&P 500 Utilities Index has been the top performer, outpacing the broader S&P 500 Index by 3.25 percentage points year-to-date through 5/14/24.

One reason for the Utilities sector’s outperformance so far in 2024 is the rise in global usage of Artificial Intelligence (AI). The International Energy Agency reported that the global electricity consumed by data centers, which typically house the servers that host AI graphics processing units, is forecast to surge from an estimated 460 terra-watt hours in 2022 to more than 1,000 terra-watt hours in 2026. For comparison, this demand is roughly equivalent to the electricity consumption of Japan.

• From 12/29/89 – 5/14/24 (period captured in the table above), the average annualized total returns posted by the four equity indices presented were as follows (best to worst): 11.60% (S&P 500 Health Care); 10.51% (S&P 500 Consumer Staples); 10.39% (S&P 500); and 8.19% (S&P 500 Utilities); according to data from Bloomberg.

Takeaway

Today’s table reveals that defensive sectors often outperform the broader S&P 500 Index during periods of higher inflation. The S&P 500 Index underperformed at least one defensive sector in roughly 83% of the calendar years (including year-to-date) where inflation increased at a rate of 3.0% or more on a trailing 12-month basis since 1990. That said, outliers do exist, as proven by the S&P 500 Index’s performance in both 2021 and 2023. Additionally, as there is no way to predict which defensive sector will offer the best performance when inflation is elevated, investors should take care to remain appropriately diversified. From our perspective, if the CPI remains at 3.0% or above, we expect investor interest in defensive sectors will continue to grow; perhaps even more so if the economic climate begins to deteriorate.