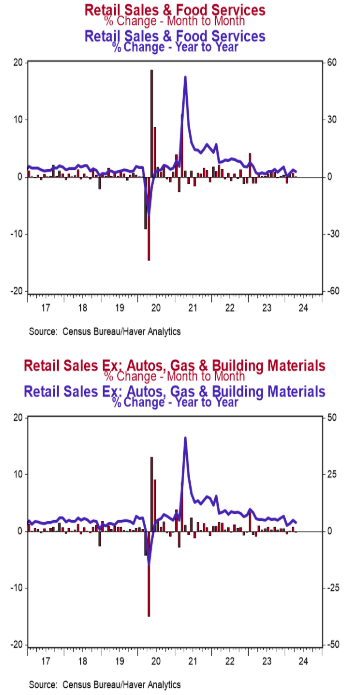

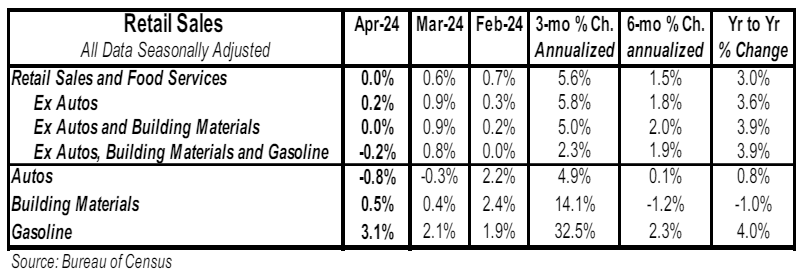

- Retail sales were unchanged in April (-0.4% including revisions to prior months), lagging the consensus expected gain of 0.4%. Retail sales are up 3.0% versus a year ago.

- Sales excluding autos rose 0.2% in April (-0.3% including revisions to prior months), matching consensus expectations. These sales are up 3.6% in the past year.

- The largest increase in April, by far, was for gas stations. The largest declines were for nonstore retailers (internet and mail-order) and autos.

- Sales excluding autos, building materials, and gas declined 0.2% in April and were down 0.9% including revisions to prior months. If unchanged in May/June, these sales will be up at a 1.3% annual rate in Q2 versus the Q1 average.

Implications: A weak report on the US consumer today with retail sales remaining unchanged in April, revised downward for prior months, and seven out of thirteen major categories falling for the month. Factoring in those revisions to prior months, retail sales fell 0.4% versus a consensus expected gain of 0.4%. Sales were propped up by a sizable 3.1% increase at gas stations, which was largely due to rising gasoline prices in April and is not a reflection of improving living standards. Stripping out gas stations along with the often-volatile categories for autos and building materials, “core” sales declined 0.2% and were revised to an even weaker -0.9% after factoring in changes to previous months. The drop in core sales was led by an outsized 1.2% decline in sales at nonstore retailers (think internet and mail-order), the biggest drop for that category since late 2022. Core sales – which are crucial for estimating GDP – looks to be softening of late, down in three out of the last four months. While the US consumer has remained resolute in the face of higher borrowing costs since the Fed began hiking interest rates more than two years ago, today’s report adds to the growing list of evidence that consumers may finally be running out of the artificial stimulus that was pumped into the economy by the government during the COVID years. It’s also important to remember that a key driver of overall spending has been inflation. While overall retail sales are up 3.0% in the last year and sit at a record high unadjusted for inflation, “real” (inflation-adjusted) retail sales are down 0.3% in the last year, and have remained stagnant for two years after peaking in April 2022. It has been 40 years since the US had an inflation problem, so investors should be aware that it can distort data. Our view remains that the tightening in monetary policy since 2022 will eventually deliver a recession. In other news this morning, the Empire State Index, a measure of New York factory sentiment, fell to a weak -15.6 in May from -14.3 in April.