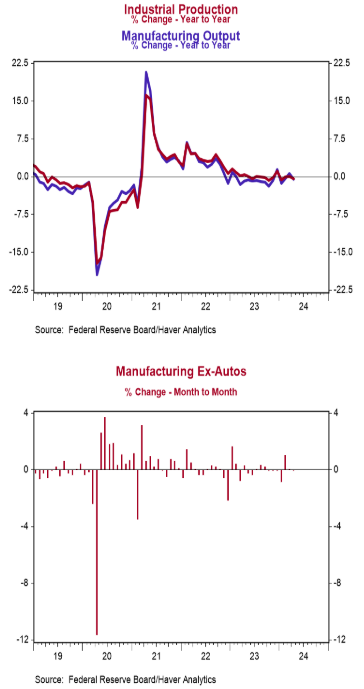

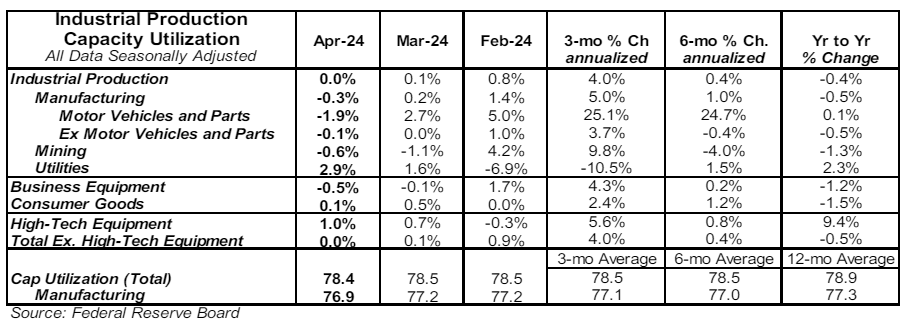

- Industrial production remained unchanged in April (+0.1% including revisions to prior months), versus a consensus expected gain of 0.1%. Utilities output rose 2.9% in April, while mining declined -0.6%.

- Manufacturing, which excludes mining/utilities, declined -0.3% in April (-0.5% including revisions to prior months). Auto production fell 1.9%, while non-auto manufacturing declined 0.1%. Auto production is up 0.1% in the past year, while non-auto manufacturing has declined 0.5%.

- The production of high-tech equipment increased 1.0% in April and is up 9.4% versus a year ago.

- Overall capacity utilization declined to 78.4% in April from 78.5% in March. Manufacturing capacity utilization fell to 76.9% in April from 77.2%.

Implications: Industrial production took a breather in April following two months of gains, with the details even weaker than the headline number. The manufacturing sector was the biggest drag on activity in today’s report, falling 0.3%. Auto production posted a decline of 1.9%, likely the result of a normalization following production surging earlier this year to get back on track following large scale strikes in late 2023. Meanwhile, non-auto manufacturing (which we think of as a “core” version of industrial production) posted a decline of 0.1% in April and is down 0.5% from a year ago. One bright spot in manufacturing in April was the production of high-tech equipment, which jumped 1.0%. This measure is up 9.4% in the past year, the strongest growth of any major category, likely the result of investment in AI as well as the reshoring of semiconductor production. That said, activity here has begun to slow recently signaling that the initial burst due to the CHIPS Act may finally be wearing off. The mining sector was also a source of weakness in April, with activity falling 0.6%. Declines in the drilling of new wells and the extraction of other minerals and metals more than offset a gain in the production of oil and gas. Finally, the utilities sector (which is volatile and largely dependent on weather) was the biggest source of strength in today’s report, rising 2.9% in April. In other news this morning, the Philadelphia Fed Index, a measure of factory sentiment in that region, fell to +4.5 in May from +15.5 in April.