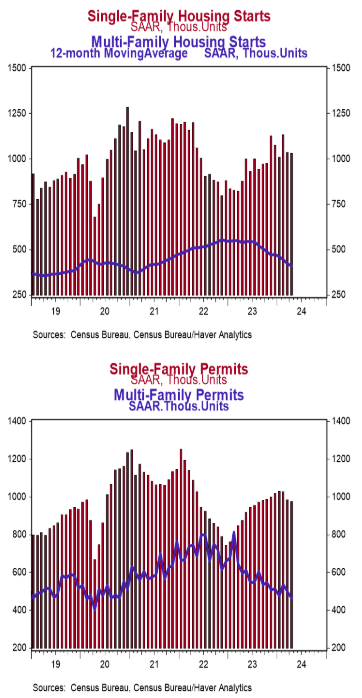

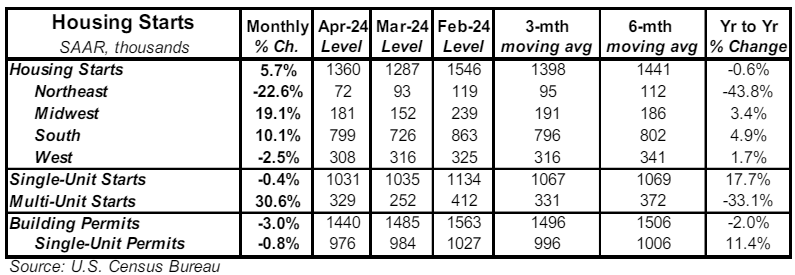

- Housing starts rose 5.7% in April to a 1.360 million annual rate, lagging the consensus expected 1.421 million. Starts are down 0.6% versus a year ago.

- The gain in April was entirely due to multi-family starts. Single-family starts fell in April. In the past year, single-family starts are up 17.7% while multi-unit starts are down 33.1%.

- Starts in April rose in the South and Midwest but fell in the Northeast and West.

- New building permits declined 3.0% in April to a 1.440 million annual rate, below the consensus expected 1.480 million. Compared to a year ago, permits for single-family homes are up 11.4% while permits for multi-unit homes are down 21.9%

Implications: Housing starts rebounded in April but remain below the pace of late 2023. The main culprit weighing on activity is mortgage rates, which have lingered higher for longer in response to higher inflation reports in recent months. However, it’s important to keep in mind that many owners of existing homes are hesitant to list their homes and give up fixed sub-3% mortgage rates, so prospective buyers have turned to new builds as their best option. This has boosted demand for developers and should keep a floor under construction activity going forward. Looking at the details of the report, the gain in April was entirely due to a 30.6% jump in multi-family starts, while single-family starts remained essentially unchanged, down 0.4% from the previous month. It looks like homebuilders were more focused on completing homes in April versus new builds, as housing completions for single-family homes jumped 15.4%, the second largest monthly gain since 2019. Another recent theme is the split between single-family and multi-family development. Over the past year, the number of single-family starts is up 17.7% while multi-unit starts are down 33.1%. Permits for single-family homes are up 11.4% while multi-unit home permits are down 21.9%. This huge gap in the data is due to the unprecedented nature of the last four years since COVID began. While we don’t see housing as a major driver of economic growth in the near term, we don’t expect a housing bust like the 2000s on the way, either. Builders built too few homes in the decade before COVID and that shortage should support home prices in the years ahead. In other housing news, the NAHB Housing Index, a measure of homebuilder sentiment, fell to 45 in May from 51 in April. A reading below 50 signals a greater number of builders view conditions as poor versus good. In other news this morning, initial claims for jobless benefits fell 10,000 last week at 222,000, while continuing claims rose by 13,000 to 1.794 million. The figures are consistent with continued job gains in May. Finally, on the trade front, import prices jumped 0.9% in April and export prices increased 0.5%. In the past year, import prices up 1.1% while export prices are down 1.0%.