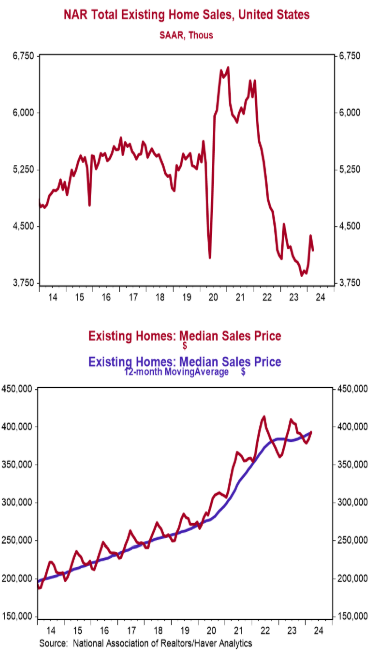

- Existing home sales declined 4.3% in March to a 4.190 million annual rate, slightly lagging the consensus expected 4.200 million. Sales are down 3.7% versus a year ago.

- Sales in March fell in the West, South and Midwest, but rose in the Northeast. The drop in March was due to both single-family homes and condos/co-ops.

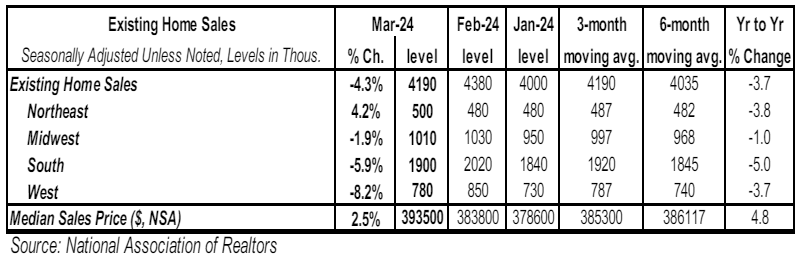

- The median price of an existing home rose to $393,500 in March (not seasonally adjusted) and is up 4.8% versus a year ago.

Implications: Existing home sales took a widely expected breather in March following the largest monthly gain in a year in February. While sales activity has finally bottomed it looks like any significant recovery is still facing headwinds from mortgage rates that remain above 7%. Mortgage rates had been dropping in early 2024, but that trend has recently reversed. The culprit is a recent string of bad inflation reports that have cast doubts on the Federal Reserve following through with rate cuts this year. Meanwhile, home prices appear to be rising again, although modestly, with the median price of an existing home up 4.8% from a year ago. The result is that affordability is still a big concern for buyers. Assuming a 20% down payment, the rise in mortgage rates since the Federal Reserve began its current tightening cycle in March 2022 amounts to a 34% increase in monthly payments on a new 30-year mortgage for the median existing home. Eventually, the housing market can adapt to these increases but continued volatility in financing costs will cause some indigestion. The other major headwind for sales has been that many existing homeowners are reluctant to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. This continues to limit future existing sales (and inventories). However, there are signs of progress with inventories rising 14.4% in the past year. That said, the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) was 3.2 in March, well below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. A tight inventory of existing homes means that while the pace of sales looks like 2008, we aren’t seeing that translate to a big decline in prices. Putting this together, we expect a modest recovery in sales in 2024. In other news this morning, initial claims for jobless benefits remained unchanged last week at 212,000, while continuing claims rose by 2,000 to 1.812 million. The figures are consistent with continued job gains in April. Finally, on the manufacturing front, the Philadelphia Fed Index, a measure of factory sentiment in that region, jumped to +15.5 in April from +3.2 in March.